The DeFi market is growing, so now may seem like a great time to launch a decentralized financial product. But before you start looking for investment, it’s essential to understand what it takes to get a secure and efficient solution that will meet your business goals and adapt to customers’ specific and ever-changing demands.

In this article, we explore the main types of DeFi apps, examine core functionality, and discuss the technology stack. You’ll also find helpful information about what pitfalls to expect when creating DeFi apps and ways to overcome them. As a bonus, we’ll take a look at 2025 trends in the DeFi world.

This article will be useful for project and technical leaders considering building a DeFi app or improving their existing solution.

What are the business benefits of DeFi?

Decentralized finance, or DeFi, is a concept that covers a variety of financial applications and protocols running on blockchain technology without engaging intermediaries like brokerages, exchanges, or banks. Instead, DeFi uses smart contracts that automatically execute digital agreements. Among popular DeFi solutions are decentralized exchanges (DEXs), crypto wallets, and lending platforms, which we’ll explore in detail later.

Financial and investment companies create their own DeFi apps to provide customers with traditional financial services such as lending, trading, and investing in a decentralized manner. DeFi app providers offer customers:

- Easier access to financial services. The decentralization brought to DeFi applications by blockchain helps businesses conduct financial operations without third-party institutions (which can be biased) while ensuring transaction security.

- Transparent person-to-person trades. Everyone shares information about all activities within the blockchain network, meaning that the network’s data is publicly available for inspection.

- Possibility for international financial transactions. DeFi platforms are available across the world for international financial transactions.

- Improved market efficiency. DeFi platforms allow for automated lending and borrowing by using crypto assets as collateral, accelerating financial transactions, decreasing costs, and expanding the availability of lending services.

- Full control over funds. DeFi applications let end users maintain full control and visibility over their funds in wallets and trading services.

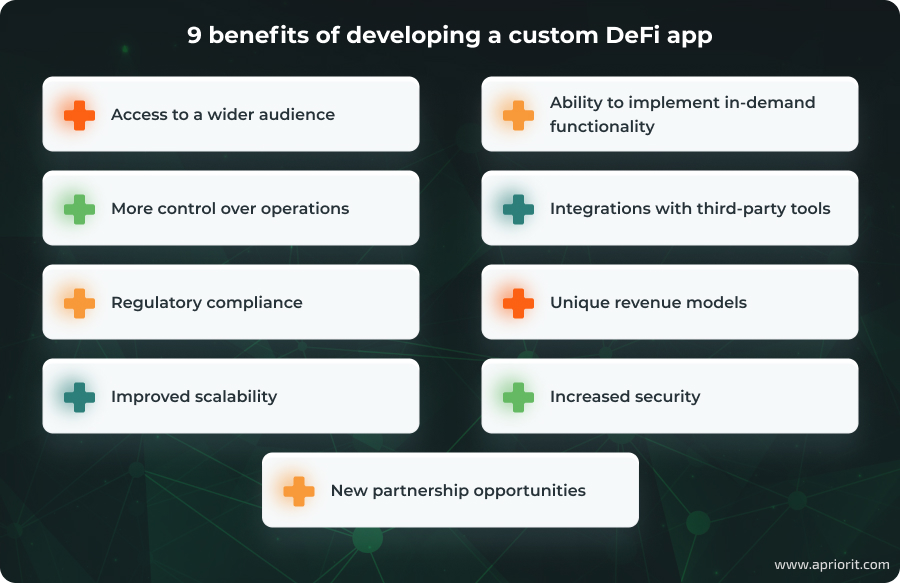

But what about financial service providers who create DeFi applications? Let’s briefly explore the key business benefits you can get when developing custom solutions instead of integrating off-the-shelf apps into your ecosystem:

- Access to a wider audience. DeFi is inherently decentralized and open to users from all over the world, unlike traditional financial services that might be limited by geographic location or regulatory barriers. With custom solutions, you can also attract new customers who are looking for cutting-edge financial products that offer more control, transparency, and rewards compared to traditional banking.

- Ability to implement in-demand functionality. Adding support for flash loans, NFTs, and decentralized insurance capabilities allows you to deliver relevant services to your customers and attract new users looking for customized financial solutions.

- More control over operations. Greater control over protocols and technologies lets you provide rapid and timely security updates, innovations, and improvements.

- Integrations with third-party tools. A custom DeFi app can seamlessly integrate with different financial systems and services.

- Regulatory compliance. Custom development allows you to add specific features to meet regulatory requirements, including local ones, and reduce potential legal risks.

- Unique revenue models. You can implement a custom revenue model, for example, transaction fees or subscription model, that corresponds to your business goals.

- Improved scalability. Custom development lets you lay the foundation for scaling your app in the future to ensure its high performance — for example, by implementing modular architecture or Layer 2 solutions.

- Increased security. A custom DeFi app allows you to provide enhanced data security that will minimize the risks of cybersecurity attacks, adhere to regulatory requirements, and increase users’ trust.

- New partnership opportunities. With DeFi apps, you can create partnerships with other blockchain-based projects. Such partnerships can help attract new customers via cross-promotions or shared liquidity pools.

If you are considering developing a custom DeFi app, it’s vital to define exactly what result you want to achieve. In the next section, we examine types of DeFi apps.

Want to build a custom DeFi solution?

Outsource software development to Apriorit’s experts in blockchain and finance product creation. Get a custom, secure, and scalable DeFi app that meets your business requirements and user needs.

9 popular types of DeFi apps

A curious thing about decentralized financial technologies is that they’re focused on recreating the entire financial ecosystem rather than just building software for separate services. DeFi projects often serve as consumer-facing financial interfaces powered by blockchain and crypto assets.

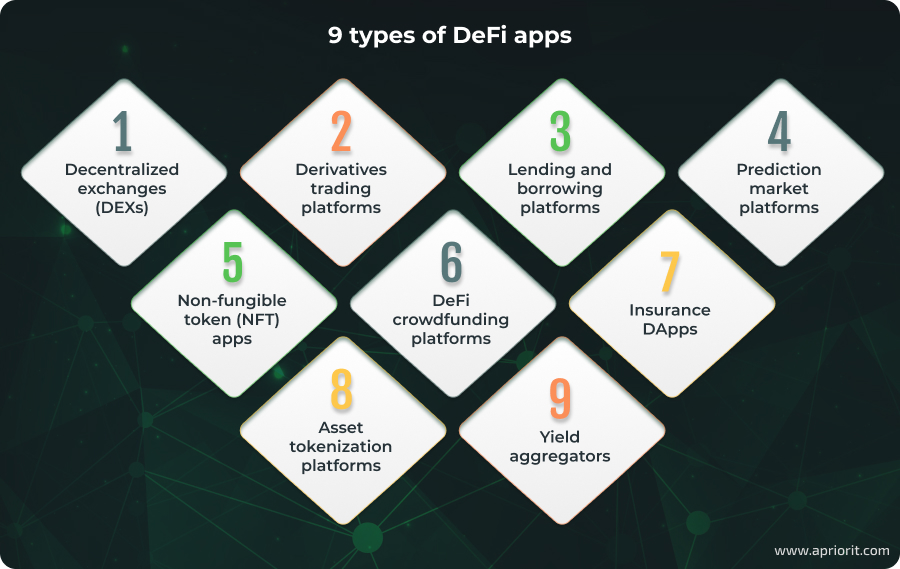

You can find DeFi products for various purposes, such as insurance, lending, and currency exchange. Let’s take a look at common types of DeFi applications:

- DEXs. Unlike traditional centralized exchanges (CEXs), DEXs ensure direct peer-to-peer cryptocurrency transactions, relying on self-executing smart contracts to facilitate trading. This allows for instantaneous trades, often at a lower cost than on CEXs. Depending on its method of facilitating trades, a DEX can be categorized as an order book DEX (like Nash Exchange), a swap DEX (like Uniswap and Balancer), or a DEX aggregator (like 1inch).

- Derivatives trading platforms. Such DeFi platforms allow users to trade tokenized derivatives using smart contracts without the need for a third party. Any product like options, futures, and collateralized loans can be a derivative. A popular protocol for derivative trading is Synthetix.

- Lending and borrowing platforms. These platforms allow lenders to instantly lend cryptocurrencies to borrowers. The main condition is that borrowers have to deposit enough collateral in a smart contract. One of the key benefits of DeFi is that there is no preferential treatment. Leading examples of DeFi lending platforms are Aave and Compound.

- Prediction market platforms. Crypto prediction markets allow anyone, regardless of status, location, and nationality, to trade the outcome of events like sports games and financial situations. The goal of decentralized prediction markets is to offer the same functionality provided by traditional prediction markets, but without intermediaries. Popular prediction market platforms include TotemFi and Augur.

- NFT apps. Using these apps, you can generate, buy, sell, and exchange NFTs. As a blockchain-based token, every NFT represents a unique asset like digital content or media and is considered an irrevocable digital certificate of ownership for a given asset. The largest NFT marketplace is OpenSea.

- DeFi crowdfunding platforms. These platforms aim at safe and transparent fundraising to finance startups, businesses, and promising projects. Modern services include the Gitcoin and MantraDAO DeFi crowdfunding platforms.

- Insurance DApps. These are decentralized solutions for mitigating risks like smart contract failure or blockchain hacks and providing automated insurance coverage through executing smart contracts. An example is Nexus Mutual.

- Asset tokenization platforms. These platforms allow you to convert valuable assets to digital tokens. Such tokens represent ownership stakes in tangible assets like real estate or art, or intangible assets like company equity and intellectual property. The tokenization process assigns a digital token to a traditional asset. This token is embedded in a public blockchain network, ensuring the record of ownership is immutable and public. Brickken and Fireblocks are two asset tokenization platforms.

- Yield aggregators. These applications aim to automate yield farming in different ways to maximize returns — for example, by reinvesting rewards or reallocating funds. One such application is Yearn.

It’s also important to mention the stablecoins. A stablecoin is a type of cryptocurrency that holds a stable price, usually because it is tied to a non-crypto asset like the dollar or euro. This type of cryptocurrency was created in response to the crypto market’s volatile nature. Having explored major types of DeFi solutions, we can move to the core features you need to consider while building a DeFi app.

Read also

How to Protect Your Assets: Crypto Wallet Security Best Practices

Get guidance on protecting your blockchain assets and mitigating potential risks.

What are the core features of DeFi apps?

Since the choice of features you want to implement will depend on the type of DeFi app you want to build, we will focus on key features that allow you to enhance the security, functionality, and user experience of any DeFi app regardless of its aim and target audience.

However, before proceeding, let’s briefly outline the principles on which DeFi applications work.

How a DeFi application works

DeFi apps use blockchain technology and smart contracts to facilitate and automate transactions without engaging intermediaries. When a user initiates a transaction, such as borrowing cryptocurrency, a smart contract automatically executes the transaction if conditions are met and updates the user’s balance in a crypto wallet.

A DeFi app’s smart contract interacts with other smart contracts on the blockchain to access or provide liquidity, execute trades, or facilitate loans. Moreover, a smart contract also uses decentralized oracles to receive external data like price feeds that are required to execute transactions.

Once initiated, transactions are verified by nodes on the blockchain network and recorded on the blockchain, ensuring transparency and immutability. Some DeFi apps also have a governance mechanism where the community can vote on proposals for updating or improving the platform and its underlying protocols.

Key features of DeFi apps

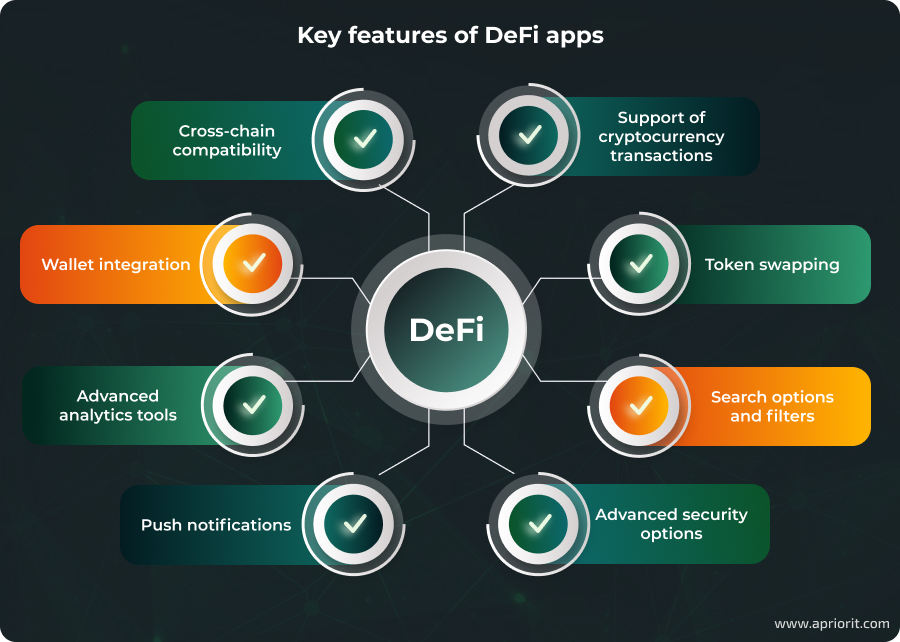

Transparency, reliability, flexibility, and security are the foundation of any modern DeFi app. To build a solution matching these criteria, you need to consider core features that include:

- Cross-chain compatibility allows your app’s users to smoothly interact and exchange data across multiple blockchain networks.

- Support of cryptocurrency transactions lets users perform various transactions with financial assets, such as currency exchange and conversion, regardless of the type of app. Moreover, adding several cryptocurrencies to support allows for transactions with several blockchain networks.

- Wallet integration helps users fully control and manage their assets, while multi-signature wallets provide extra security measures by requiring several transaction approvals.

- Token swapping allows users to exchange crypto assets directly without first converting them to fiat currency.

- Advanced analytics tools aim to track DeFi portfolios, market trends, and transaction histories and let users make weighted decisions on future transactions.

- Search options and filters help find services provided through your app, enhancing the user experience and app usability.

- Push notifications allow users to promptly react to requests or changes related to DeFi activities. They can also be used to send codes for two-factor authentication.

- Advanced security options like two-factor authentication enhance a user’s data and asset protection.

To create a robust, competitive, and secure DeFi solution, it’s crucial to choose the right technology stack at the very beginning. In the next section, we overview the most popular tools and technologies in blockchain and decentralized finance.

Technology stack for building a DeFi app

A blockchain network lays the foundation for your DeFi app and determines the choice of technology stack. Every network has its pros and cons, so it’s important to choose one that aligns with your app’s purposes.

Let’s look at the most popular platforms and tools for building DeFi apps:

Table 1: Technology stack for building a DeFi app

| System components | Technologies |

|---|---|

| Blockchain platforms | – Ethereum – Solana – Polygon – Flow – Tezos – BNB Smart Chain – Bitcoin |

| Smart contract platforms | – Solidity – Truffle – Hardhat – Embark – OpenZeppelin |

| Decentralized storage | – InterPlanetary File System (IPFS) – Swarm – Filecoin – Pinata |

| Databases | – PostgreSQL – MySQL – MongoDB – Amazon DynamoDB |

| Oracles | – Band Protocol – Chainlink |

| Programming languages | – JavaScript – TypeScript – Python – Java – Go – Rust – Vyper – Move – C++ |

| Frontend frameworks | – React – Angular – Vue.js – Bootstrap – Web3.js – Web3.py |

Blockchain platforms. Having a vast ecosystem and strong developer support, Ethereum is the most popular platform for developing DeFi apps, while Solana is known for high performance and low transaction costs.

Smart contract platforms. Solidity is Ethereum’s platform for creating and deploying smart contracts. Other popular frameworks for smart contract development and testing are Truffle and Hardhat.

Decentralized storage. IPFS is a hypermedia protocol used to store media content, while Pinata provides secure and scalable storage for files with IPFS’s decentralized infrastructure.

Databases. PostgreSQL ensures your app’s reliability and scalability, while MongoDB provides flexibility to manage the variance of data that is essential for payment processing applications.

Oracles. Services like Chainlink and Band Protocol provide real-world data to smart contracts, which is critical for many DeFi apps using stablecoins, and ensure that the data used by smart contracts is reliable and accurate.

Programming languages. JavaScript and TypeScript run on Node.js, which is valuable for blockchain apps because it enables a faster time to market and simple integrations with cloud services. At the same time, Go’s advantages are high-speed performance, ease of maintenance, and concurrency features.

Frontend frameworks. React and Vue are popular frontend frameworks that can be used to build user-friendly and intuitive interfaces and provide security features like two-factor authentication and data encryption.

Having overviewed the most used blockchain technologies, let’s take a look at the main steps of developing a DeFi app.

Related project

Building AWS-based Blockchain Infrastructure for International Banking

Explore how to build scalable and secure blockchain infrastructure for smart contracts using cloud-based solutions.

How to build a custom DeFi app: 10 key steps

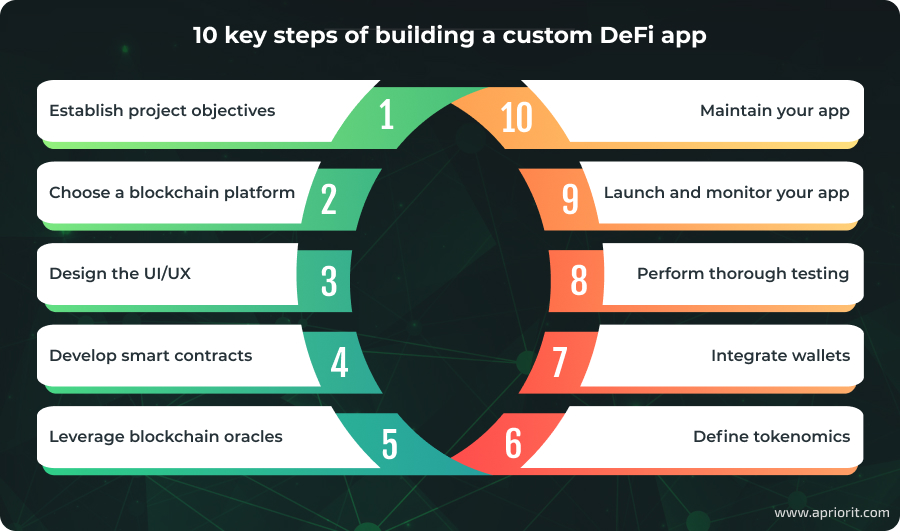

The steps of building DeFi apps can vary depending on the purpose of your solution and choice of features, but in most cases, they include the following:

- Establish project objectives. Define the goal and scope of the DeFi project. This involves conducting market and competitor research, estimating required resources, and planning how to mitigate the potential risks you can face during DeFi app development.

- Choose a blockchain platform. Pick out a platform that will meet all your project goals. Consider scalability, security, transaction speed and costs when making a decision.

- Design the UI/UX. Create a user-friendly and intuitive interface that demonstrates your solution’s complexity in an understandable way. To enhance the UI/UX, you can also conduct usability testing and collect user feedback.

- Develop smart contracts. Define smart contract conditions precisely, keeping in mind that they will be the main trigger for executing transactions. At this stage, it’s crucial to thoroughly test error handling, security measures, and contract integration, ensuring they work correctly after deployment.

- Leverage blockchain oracles. Integrate external data sources to improve your app capabilities and enable smart contract execution based on real-world data, from climate forecasts to financial market information.

- Define tokenomics. Implement tokens and mechanisms for working with them. At this stage, you need to decide how tokens will be distributed among users, whether users with tokens will have voting rights, and more.

- Integrate wallets. Make sure your app is compatible with popular wallets, and take measures to protect wallet data, such as encryption and authentication.

- Perform thorough testing. Conduct comprehensive testing to guarantee your app works correctly. It’s also crucial to perform regular security audits against vulnerabilities.

- Launch and monitor your app. Launch your app and monitor users’ feedback to promptly address issues and improve functionality and the user experience.

- Maintain your app. Release new app versions and regular security updates to ensure your app is secure, efficient, and reliable.

Before moving to DeFi app development, it’s important to know what obstacles you may face while building your DeFi product and how to overcome them.

What to consider when creating a DeFi app

Here, we explore what you need to consider to avoid potential risks and recommend ways to enhance the overall development process.

1. Smart contract limitations. Any malfunctioning smart contracts will inevitably affect your DeFi solution’s entire ecosystem. For example, errors in code can lead to the loss of funds locked in the smart contract and misused smart contract processes, while a lack of mechanisms to prevent end-users’ errors may be a reason for potential customers not to choose your DeFi app.

A proven way to improve smart contracts is sticking to development best practices. Although smart contract architectures may vary depending on a project’s specifics, there are several essential practices that can help you develop robust smart contracts:

- Carefully choose a blockchain network, as it often determines the programming language you can use for writing smart contracts.

- Follow your blockchain network’s development standards when adding extra functionality to a smart contract.

- Pay close attention to smart contract testing. Once smart contracts are deployed, there’s no way to change them and fix bugs detected at the last minute. To ensure a thorough testing process, use tools for test coverage analysis, static code analysis, formal verification, and symbolic execution.

2. Complex regulatory compliance. Creating a DeFi app requires you to be oriented in a complex and ever-changing regulatory landscape. There is no one set of rules regulating DeFi apps, since the rules vary depending on the country.

Being aware of the latest regulations in your target market is key to avoiding potential legal problems. For example, following Know Your Customer (KYC) and Anti-Money Laundering (AML) rules will protect your users from fraud, while consulting with legal experts in blockchain and finance will keep you updated on the latest regulatory changes.

3. Liquidity management. In the blockchain world, sufficient liquidity is necessary to create efficient markets and ensure speedy and seamless transactions. High liquidity means that a digital asset can be traded in large volumes with little impact on its price, while low liquidity causes unstable prices that create significant risks for market participants.

One way to attract enough liquidity is to use atomic swaps — automatic exchange contracts that allow two parties to trade tokens from two different blockchains. This approach seems reasonable, but it still doesn’t solve the issue of flooding the market with a raft of highly specialized tokens.

Another possible way to address low liquidity is to use decentralized liquidity pools. Liquidity pools contain tokens locked into a smart contract. They are supposed to facilitate efficient asset trading while allowing investors to earn a return on their holdings. Thus, a DEX serves as a marketplace where buyers and sellers agree on asset prices based on the relative supply and demand.

Read also

How to Use Atomic Swaps to Implement a Decentralized Exchange (DEX)

Unlock seamless crypto trades with atomic swaps! Learn how this technology enables secure, decentralized exchanges without intermediaries.

4. Scalability and performance. From blockchains, DeFi solutions inherited not only benefits like security and transparency but also major drawbacks like slow transaction speeds (compared to centralized finance) and scalability issues, which significantly reduce overall system performance.

To enhance the scalability of your DeFi app, opt to use Layer 2 scaling technologies like state channels or sidechains. For example, for Ethereum-driven projects, state channels are a possible solution for improving blockchain scalability. State channels allow users to transact with one another directly outside of the blockchain (off-chain) and greatly minimize their use of on-chain operations. This approach can significantly reduce the strain on blockchains by simply grouping similar transactions. Thus, it reduces the overall number of transactions and improves both scalability and transaction speed.

5. Hacking and attacks. Malicious actors will always remain a threat to the financial sector, attempting to come up with new ways to steal funds. The most common dangers DeFi projects must watch out for include re-entrancy and flash loan attacks.

- A re-entrancy attack is a type of vulnerability exploit that occurs when an external contract calls back into the vulnerable smart contract, leading to unauthorized fund withdrawals.

- A flash loan attack aims to use borrowed sums of money to exploit vulnerabilities in DeFi protocols within a transaction. Attackers manipulate protocol logic, which may cause significant financial losses for platforms.

The most common and straightforward way for malicious actors to hack a crypto project is to find and exploit vulnerabilities. This is why thoroughly checking all your code for weak spots and conducting a security audit is a must to prevent your DeFi application from being hacked.

Another way to eliminate the majority of vulnerabilities is to put all your efforts into writing flawless code. The best practices for keeping your DeFi project’s code clean and efficient highly depend on the limitations of the blockchain protocol you’re using.

In addition, you can use metrics monitoring tools that will help you detect suspicious activities before they lead to negative consequences.

Along with the challenges, you also need to consider new tendencies in the DeFi market. Let’s take a closer look at the trends in 2025.

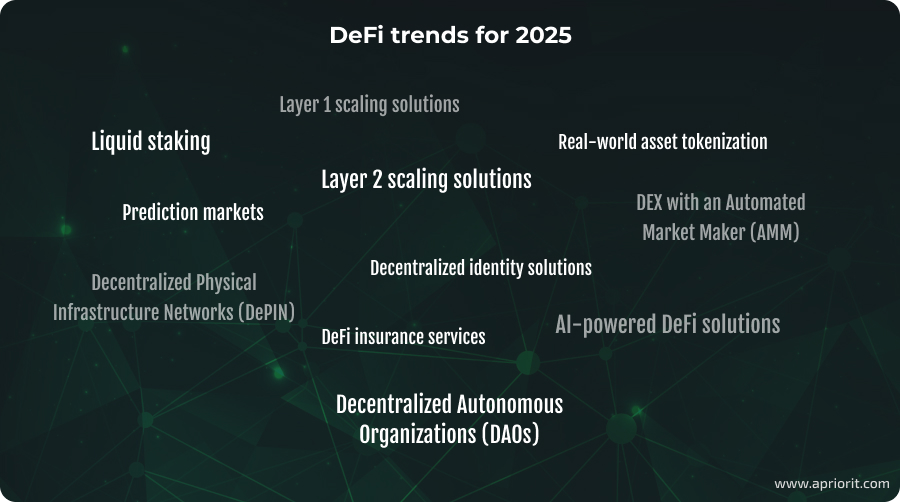

Top DeFi trends for 2025

Since the DeFi world is constantly developing and changing, it’s essential to follow the trends to remain competitive. Below are the top DeFi trends of the year that you can consider before starting your DeFi project.

- Liquid staking provides flexibility in managing staked assets across other DeFi apps and maintains liquidity while earning rewards. This option allows you to deposit assets into a liquid staking protocol and then use the tokenized versions of such assets in different ways, such as trading them on DEXs or re-staking them on other platforms.

- Real-world asset tokenization allows for tokenizing financial and physical assets that can be used as collateral or included in index funds. Tokenizing real-world assets enhances liquidity and broadens market participation.

- Layer 1 scaling solutions, which include consensus mechanisms and sharding, allow for addressing limitations of earlier blockchains and improve DeFi app scalability and security.

- Layer 2 scaling solutions, like rollups and state channels, are more flexible and aim to improve the scalability of transaction processing.

- Prediction markets, which have become popular platforms for political and financial polling, function like exchanges and allow for trading contracts based on future events.

- Decentralized identity solutions are designed to provide security, control, and privacy for confidential data. They are popular in finance, the public sector, and healthcare. Moreover, these solutions use KYC/AML protocols to only share necessary user data.

- A DEX with AMM helps avoid the main problem of DEXs, which is a lack of liquidity. By matching trading pairs automatically, AMM can limit liquidity shortages, providing secure trading at a low cost.

- AI-powered DeFi solutions help increase operational efficiency, provide personalized services for users, mitigate risks, and prevent fraud.

- DeFi insurance services offer users various types of coverage, such as against smart contract failures or protocol malfunctioning, and allow for generating higher ROI within a short time period.

- DAOs are governed by a special smart contract and aim to provide governance, conduct token sales, and aid users in business development. DAOs are run by a community of users with voting rights against DAO decisions. Businesses employing DAOs gain contributions from their active members.

- DePIN serves as a marketplace for peer-to-peer resource sharing and provides governance token holders with a right to manage physical infrastructure for computing, telecommunications, energy, and more.

Building a trendy, secure, and stable DeFi application that meets all users’ demands is not trivial and requires engaging specialists with solid knowledge in blockchain development. Let’s explore how Apriorit experts can help you with this job.

Read also

Blockchain for Supply Chains: A Practical Example of a Custom Network Implementation

Optimize your supply chain with the power of blockchain. Find out how FiberChain can help you improve traceability and security in logistics.

How Apriorit can help you with building a DeFi app

With more than 20 years of development experience, Apriorit adheres to secure SDLC principles and provides various services in many industries, from FinTech to cybersecurity. Our range of services includes:

- Conducting a discovery phase to set project goals and resource estimates

- Developing blockchain-based solutions that meet the client’s demands and expectations

- Auditing smart contracts to discover security vulnerabilities and weak spots

- Performing blockchain security audits and testing to assess your solution and provide a list of recommendations on mitigating security risks

- Providing AI development services to power your solution with advanced technologies

- Scaling DeFi apps using Layer 2 solutions for better performance

In addition, you can outsource development tasks to Apriorit’s dedicated teams that are experienced in creating robust and secure solutions. Apart from developers who know how to build a DeFi app, you can employ a skillful project manager to efficiently organize all work processes and a QA team to help ensure top-notch quality assurance.

Involving an Apriorit business analyst with experience in crypto and FinTech projects will help you research industry specifics and identify both opportunities and pitfalls for your project before starting DeFi application development.

Conclusion

Building a reliable and intuitive DeFi app is challenging, from selecting a blockchain platform to navigating potential obstacles you need to consider before moving to development. However, by being aware of the potential risks and tendencies in the DeFi world, you can create an efficient and competitive software product.

As experts in cybersecurity solutions, we know how to combine the efforts of our professional blockchain development and quality assurance teams to deliver robust DeFi apps with exceptional security.

Looking for professionals in blockchain development?

Transform your financial services with secure, transparent, and decentralized solutions delivered by seasoned Apriorit software engineers.