FinTech companies collect transaction logs, customer credit histories, market trends, and lots of other sensitive data. On the one hand, storing and processing all of this information can be overwhelming. But on the other hand, using this information for big data analytics in business workflows can help FinTech companies improve customer personalization, enhance risk analysis, and level up the competitiveness of their products and services.

This article explores how big data helps FinTech companies, covering business benefits, major use cases, challenges, and ways to overcome them. This post will be helpful for project and development leaders who are considering leveraging big data in FinTech products.

Why FinTech needs big data

Big data is a term covering extremely large and complex datasets of various kinds that can’t be easily collected, managed, and analyzed without specific software or tools.

FinTech companies are uniquely positioned to leverage big data solutions as they gather tons of information:

- Bank transaction data related to credit and debit card payments, wire transfers, loan records, etc.

- Information regarding stock market trends, trading, and price movements

- Customer behavior data, such as online purchase patterns, credit history, spending habits, and customer interaction history

- Analytical and regulatory information like Know Your Customer (KYC), anti-money laundering (AML), and suspicious activity reports

- Alternative data, including on mobile app usage, social media activity, and IoT device usage

What are the benefits of big data in FinTech?

To maximize the value of all the data they obtain, FinTech organizations rely on advanced tools for big data analysis. Such specialized software helps organizations get valuable insights — for example, into how customers use their products and services. Let’s take a closer look at the main advantages big data can bring to the table:

- Improve decision-making. By analyzing vast amounts of data, businesses can identify trends, patterns, and risks that inform strategic choices. This leads to more accurate risk assessments and better strategic planning based on factual insights from processed information rather than intuition.

- Increase efficiency. Comprehensive big data analytics practices, enhanced with machine learning algorithms and real-time data processing, allow FinTech organizations to identify bottlenecks in workflows. As a result, businesses can use discovered information to eliminate inefficiencies by automating some manual processes like loan approvals.

- Reduce expenses. Process automation helps FinTech companies reduce operational costs. Additionally, big data analysis might assist in identifying areas where resources can be optimized, further contributing to cost savings.

- Reach a wider audience. Efficient big data analytics allows FinTech companies to expand their reach by identifying new customer segments, personalizing services, and improving accessibility. For example, FinTech firms can offer loans, credit, and financial services to underserved markets. While traditional banks might reject individuals with an unusual credit history, big data can enable alternative credit scoring.

Extensive financial, customer, and market datasets can offer significant advantages to FinTech businesses. By extracting key insights into customer behavior, preferences, historical trends, and market conditions, companies can make more informed decisions and optimize their strategies. With this information in mind, let’s explore practical examples of using big data for FinTech.

Unlock the power of big data in FinTech!

Recruit Apriorit engineering experts to build a custom solution that will help you extract valuable insights from large datasets and leverage them to keep your business competitive.

Use cases of big data in FinTech

As a result of successful big data analysis, organizations can gain valuable information that helps them upgrade various types of services:

- Online payments

- Trading and investing

- Insurtech

- Lending and microfinancing

- And others

As of now, the most common uses of big data in FinTech are the following:

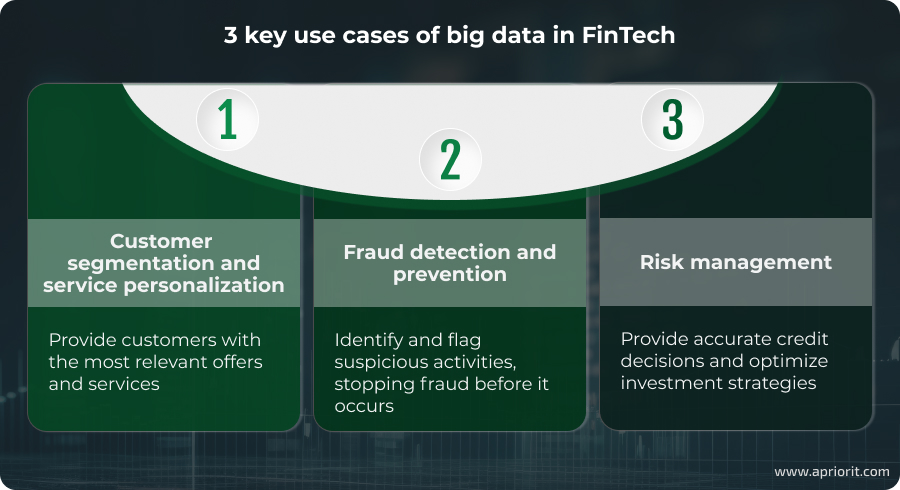

1. Customer segmentation and service personalization

The key use case of big data in FinTech is to categorize customers into different groups based on:

- Spending behaviours

- Demographic details

- Transaction history

- Income

- Education

- Job type and industry, etc.

Such segmentation allows for creating highly targeted marketing campaigns tailored to the preferences of specific customer groups. Data scientists usually apply decision trees, clustering, and linear regression for such tasks. As a result, FinTech businesses can optimize their marketing efforts, creating tailored offers quickly and efficiently.

For example, your team can decide to customize client interactions by developing an AI-driven bot that’s trained on prior communications and customer profiles.

Expected results: Businesses improve brand awareness and loyalty by providing customers with offers relevant to their interests and financial capabilities.

2. Fraud detection and prevention

Big data analytics also comes in handy when preventing fraud and enhancing the security of sensitive data. Businesses can identify suspicious patterns and anomalies to detect and block potentially fraudulent activity before it causes harm. Such early detection saves financial institutions from monetary and reputational losses; it also defends customer data from leaks.

To enhance the security and integrity of financial operations using big data, consider applying several technologies and methods, including:

- Real-time transaction monitoring

- Predictive modeling

- Behavioral analytics

- Artificial intelligence (AI) and machine learning (ML) algorithms

Expected results: Proactively identify and flag suspicious activities like money laundering or identity theft, potentially stopping fraud before it occurs.

3. Risk management

Another crucial big data use case in finance is extracting and processing historical trends. Analyzing those trends is helpful for predicting future risks and facilitating dynamic risk management. These are some possible use cases:

- Credit risk assessment. Big data analytics help FinTechs assess customer creditworthiness by analyzing credit history, income levels, and repayment behavior. Also, businesses can incorporate information from social media activity, transaction history, and online behavior to access additional data beyond traditional credit scores. This enables lenders to make informed decisions about extending credit and setting interest rates.

- Market risk analysis. Thanks to investigating historical market trends, FinTech businesses can create better simulations of how different economic scenarios impact investments and their products or services. This allows you to predict potential downturns and risks and prepare action plans to address them.

- Operational risk management. Big data analysis might also assist in tracking key risk indicators of service disruptions, cybersecurity threats, human errors, workflow inefficiencies, and even financial losses.

Expected results: FinTech businesses can make faster and more accurate credit decisions, adjusting interest rates based on real-time risk analysis. Analysis of market history trends allows FinTechs to optimize their investment strategies and financial planning.

Related project

Building AWS-based Blockchain Infrastructure for International Banking

Explore how our experts built scalable and secure AWS blockchain infrastructure for international banking, ensuring compliance, high availability, and seamless integration with financial systems.

Key functionalities for analyzing big data in FinTech

To harness the full benefits big data can bring to your FinTech project, you need the right technologies on your side. Below, we list a few critical technologies and functionalities that FinTech organizations should consider when integrating big data into their operations:

- Data warehousing functionalities allow for storing and managing large volumes of data from various sources, as well as for analyzing historical data.

- Data mining helps FinTech companies derive insights from unstructured data by using statistical analysis and machine learning to discover hidden patterns, correlations, and anomalies within large datasets.

- Stream processing helps companies process and analyze large amounts of data as it flows in from various sources.

- Modeling helps FinTech businesses create structured data representations to analyze, interpret, and make predictions based on large datasets. This process includes identifying data sources, types, and structures to ensure a cohesive data strategy.

- Distributed computing allows for solving complex problems like analyzing large volumes of data by having multiple computers work together on a common problem.

- Cloud computing provides scalable storage and computing power for handling large financial datasets.

- ML algorithms that enhance risk analysis and forecasting features make predictions on certain actions based on previous experience, which is especially useful for banking and insurance products. Such predictive analytics is helpful for fraud detection, credit scoring, and algorithmic trading.

- AI-powered real-time analytics allows you to process data from transactions, markets, and customer interactions in real time.

- Natural language processing (NLP) can be applied in chatbots and sentiment analysis, helping your FinTech product efficiently collect and analyze large volumes of data coming from different sources.

It’s also crucial to make sure your big data analytics solution has all the integrations needed to receive data from different sources including databases, FinTech applications, websites, and CRM systems.

Read also

Python for Building FinTech Solutions: Benefits, Tools, and Use Cases

Python is revolutionizing FinTech with its flexibility, security, and data processing power. Discover how its support of AI, blockchain, and risk management can boost your financial applications.

Challenges of using big data in FinTech

Though big data technologies have lots of benefits, it’s also a challenge to implement them into your business processes. Let’s discover the main challenges of implementing big data analytics in FinTech projects and discuss how to deal with them:

1. Regulatory pressure

Finance is a highly regulated industry, so it’s challenging to meet all regulations, especially when using complex technologies like big data. Non-compliance can lead to fines, reputational losses, and legal expenses.

Applicable standards, frameworks, and regulations may vary for different FinTech companies depending on the countries (and US states) they operate in as well as on the services they provide. These are a few of the most common:

- Anti-Money Laundering Directive (AMLD)

- General Data Protection Regulation (GDPR)

- Payment Services Directive 2 (PSD2)

- Bank Secrecy Act (BSA)

- U.S. Securities and Exchange Commission (SEC) Regulations

- California Consumer Privacy Act (CCPA)

- Gramm-Leach-Bliley Act (GLBA)

How to address regulatory pressure: Consider using a regulatory-first approach when building and expanding your FinTech product, as integrating compliance into product development can help you avoid costly redesigns later. Also, make sure your software development vendor applies security best practices by following proven standards like ISO 27001 and NIST Cybersecurity Frameworks for enhanced data protection. Putting extra effort into data protection significantly simplifies the process of meeting regulatory requirements.

2. Security risks

FinTech companies collect lots of sensitive information on users, from geolocation and credit card information to social security numbers and data on financial activity. This is why a security breach in a FinTech product can wreak havoc. And the more data your business collects, stores, and processes, the more effort you have to put into its protection.

The risks to look for are numerous, from system vulnerabilities and data leaks to cyber attacks and ransomware. To provide reliable cybersecurity, your team requires a comprehensive strategy.

How to address security risks: When developing a data protection strategy, focus on your FinTech business model and software specifics. We can outline approaches that are worth applying no matter what product you create:

- Implement strong data encryption measures like E2EE, AES-256, TLS 1.3, tokenization, and data masking techniques.

- Follow a zero trust security approach: least privilege access, multi-factor authentication, biometric authentication, and role-based access control.

- Employ data anonymization measures.

- Conduct routine security audits.

- Strengthen API security with OAuth 2.0, OpenID Connect (OIDC), API gateways, and API rate limiting.

- Ensure secure data backups.

- Create and implement a disaster recovery plan.

3. Data quality and accuracy

Inconsistent, incomplete, or duplicate data can lead to inaccurate insights and poor decision-making. Therefore, FinTech teams have to come up with ideas for cleaning and normalizing data from multiple sources: banks, credit bureaus, transaction logs, etc.

The key risks related to data quality and accuracy include the following:

- Data inconsistency. Since data comes from multiple sources like banks, social media, credit bureaus, and transaction logs, it may not be uniform, which significantly complicates data analysis.

- Incomplete or missing data. Some datasets may lack critical information due to input errors or system limitations.

- Data redundancy and duplication. Repetitive or conflicting records can also distort or slow down analysis.

- Outdated information. Financial data needs to be updated in real time to remain relevant. Outdated data can lead to faulty analysis and misguided decisions.

- Fraudulent data. Fake transactions, synthetic identities, and fraud attempts can compromise data reliability.

How to address concerns around data quality and accuracy: Consider implementing strict policies that define data sources, formats, and usage. Then, adopt tools to detect and correct inconsistencies, missing values, and duplicate records. Leverage AI-driven anomaly detection to flag suspicious or incorrect entries. You can also deploy AI models to cross-check data accuracy by comparing multiple sources.

4. Data bias

If big data used for credit scoring, fraud detection, or investment predictions is biased, it can lead to unfair treatment of customers. Ensuring ethical AI and fairness in financial decision-making is a growing concern.

Let’s explore a few scenarios of data bias that FinTechs can encounter:

- If past financial decisions were biased based on racial, gender, or geographic discrimination in lending, AI models trained on such data will inherit those biases.

- If a dataset underrepresents certain demographics — for example, people with little to no credit history — algorithms might make inaccurate predictions for those groups.

- If one group is overrepresented in the training data, predictions may favor them without valid reasons.

How to address data bias: Ensure datasets represent a diverse mix of users across age, gender, race, geography, and income categories. You can also use alternative data sources like rent payments, utility bills, and mobile transactions to improve credit access for some groups. Adopt bias detection tools like IBM AI Fairness 360 or Google’s What-If to check for bias in datasets, machine learning models, and state-of-the-art algorithms.

5. Cost of infrastructure and processing

FinTech solutions often need to integrate data from multiple financial institutions, APIs, and third-party services. To handle real-time data streams and ensure high software availability and performance, you’ll need advanced infrastructure.

Storing and processing massive volumes of financial data requires cloud services, high-performance databases, and scalable computing power. The cost of maintaining big data systems can be prohibitive for startups and small FinTech firms. The expenses also rise if you’re implementing big data in legacy systems that are not compatible with modern big data solutions.

How to address infrastructure and processing costs: Make sure your development team thoroughly researches and calculates the most suitable option for data storage and effective computing considering your business needs. We recommend you start by exploring serverless computing and hybrid clouds. To optimize data storage costs, consider using data compression and deduplication techniques. For efficient data processing and computation, leverage batch processing, stream processing, and query performance optimization.

Related project

Developing a Decentralized Asset Market on the Tezos Blockchain

Unveil the details of building a cutting-edge blockchain asset marketplace on Tezos to leverage smart contracts for secure transactions and ensure a seamless user experience.

How Apriorit can assist you with FinTech development

At Apriorit, we combine our 20+ years of experience in software development with proven and cutting-edge technologies to successfully deliver FinTech solutions as well as to improve existing finance and banking projects. We’re also experts at helping clients integrate big data analytics tools.

Whatever request you have in mind, our professional software engineers and quality assurance specialists are here to assist you. For example, you can leverage our FinTech development services services to:

- Build a competitive and secure mobile banking app, from market research and MVP creation to full-scale solution development and support

- Enhance the cybersecurity of your existing applications with strong authentication methods, secure communication protocols, behavioral analytics, and rigorous testing

- Implement advanced mechanisms for fraud detection, leveraging AI and ML to secure your critical assets and customer data

- Develop complex projects like crypto asset markets and deploy blockchain infrastructure for banking and financial organizations

- Conduct independent smart contract security analysis to better evaluate protection for your DeFi projects while receiving practical advice on eliminating discovered vulnerabilities

- Create protected crypto wallets and enhance security measures for existing ones

Apriorit can assist you with merging FinTech and big data analytics. You can request full-scale development from scratch to enhance existing solutions with advanced functionality, or we can help you maintain and update legacy systems. You can also benefit from the secure software development lifecycle, which makes sure your solution is protected during each step of development.

Conclusion

FinTech companies are integrating and analyzing big data to stay competitive on the market. Insights from extensive datasets help businesses improve their own workflows, enhance decision-making processes, offer personalized services to end-users, and better react to ever-changing market trends.

It’s crucial to use big data in combination with other technologies like machine learning, artificial intelligence, cybersecurity mechanisms, and advanced analytics functionality. Such a combination can help you make accurate forecasts, prevent fraud, reduce security risks, protect customer data, and comply with regulations.

If you want to create a FinTech product or enhance an existing solution with big data algorithms, artificial intelligence, or machine learning, feel free to contact Apriorit. Our experts know how to implement big data analytics in your project and are ready to help. We’ll gladly assist you with all steps of efficient FinTech software development, including comprehensive research and discovery processes, AI and ML integration, and advanced data management software development.

Want to leverage big data for FinTech success?

From predictive analytics to fraud prevention, let big data revolutionize your FinTech project. We will take care of the technical side.