Key takeaways:

- While white-label BNPL products abound, a custom BNPL solution caters to a provider’s business goals. But it requires thorough planning before development.

- The right choice of business model, functionality, and technologies allows for developing a reliable BNPL solution that can adapt to different users’ demands.

- Implementation challenges include ensuring data security and regulatory compliance, which are crucial for FinTech products.

- Outsourcing development to experts in FinTech software lets you overcome challenges and get a competitive BNPL solution.

As Buy Now Pay Later (BNPL) financing becomes increasingly popular, FinTech companies are rushing to enter this market by launching and integrating their BNPL solutions with merchants’ platforms.

Despite the existence of many white-label BNPL solutions, BNPL service providers often choose to develop their own products tailored to their specific business goals and the needs of their target audience. However, building a custom BNPL solution requires precise preparation, from defining the right features and options to selecting the appropriate technology stack.

In this article, we explore basic and advanced BNPL features, technologies used for developing BNPL solutions, and how to address challenges when building a custom product.

This article will be useful for product and technical leaders considering creating their own BNPL software.

BNPL market overview: numbers, trends, and key players

BNPL financing lets consumers split the cost of a purchase into installments. This concept has become popular among consumers, as it lets them get almost any item instantly on credit and without paying interest. BNPL providers, in turn, benefit from additional revenue and customer acquisition.

BNPL services are available both in e-commerce and offline stores, embracing industries such as healthcare, education, and travel. According to IMARC Group, the BNPL market will grow from US$9.6B in 2024 to US$64.0B in 2033 due to the development of digital infrastructure and extensive research and development activities.

Among the trends in the BNPL market are the following:

- Use of advanced technologies. Adopting AI to assess the customer’s creditworthiness and potential fraud risk allows BNPL service providers to make thorough decisions on credit approvals and mitigate risks of non-payment.

- Increased demand for BNPL services across industries. Demand for BNPL services in the retail and healthcare industries is rising. This is due to the flexible payment options offered by BNPL service providers and to the fact that BNPL makes expensive things (like luxury products or medical treatments) more accessible.

- Intense competition with banks. Banking institutions like American Express and JPMorgan Chase are entering the BNPL market by integrating BNPL solutions into their products. This increases competition among BNPL services providers like Klarna, Affirm, and Afterpay, leading to emerging BNPL options.

- Regulatory tightening. While the BNPL market is growing, regulation is becoming more stringent due to new rules governing BNPL service providers’ activities. For example, in 2024, the US Consumer Financial Protection Bureau (CFPB) issued an interpretive rule confirming that BNPL lenders are credit card providers and must guarantee consumers some key legal protections and rights that apply to conventional credit cards. These include the right to dispute charges and demand a refund from the lender after returning a product purchased with a BNPL loan.

Key players in the BNPL market

The BNPL market is highly competitive, so before building your own BNPL solution, you should analyze the best Buy Now Pay Later solutions. Such an analysis will help your business discover both common and unique features and decide what might be applicable to your target audience and business goals. It’s essential to consider differences in credit conditions and look at technology stacks.

For example, Klarna, a popular BNPL service available in more than 45 countries and integrated with major e-commerce platforms, offers different payment models, such as Pay in 4 and Pay in 30 days, but charges late fees. Another popular BNPL provider, Affirm, which works with more than 320,000 merchants, offers flexible repayment options from six weeks to 60 months and leverages an AI-powered analytical model to prevent fraud. Afterpay, a significant player in the retail sector, provides AI-powered customer behavior analytics that allows merchants to target new audiences more effectively. For example, Pandora’s partnership with Afterpay helped it make justified marketing decisions and attract highly engaged young customers.

Different BNPL solutions may propose different credit terms and repayment options. Thus, before launching your own BNPL product, make sure to clearly understand what solution you want to build and what audience you will target. In the next section, we examine key BNPL business models and the main differences between them.

Looking for experts in BNPL software development?

Entrust this task to Apriorit’s professionals and let us build a competitive and reliable BNPL solution.

Business models and core differences among BNPL solutions

Although there are various types of BNPL solutions on the market, there are just two widely used BNPL business models:

- Business-to-business (B2B). The goal of such BNPL solutions is to help businesses like manufacturers and retailers purchase products and services from other businesses with the possibility of repayment over a period of time.

- Business-to-customer (B2C). Such BNPL solutions are designed for individual consumers, enabling them to make purchases at various price ranges under conditions defined by a BNPL service provider.

Let’s explore how these models differ, considering criteria such as workflow, technical considerations, and revenue models:

Table 1: Comparing B2B and B2C models for BNPL solutions

| Criterion | B2B model | B2C model |

|---|---|---|

| Workflow | When a business selects products or services to purchase, a BNPL provider evaluates the business’s credit score, approves the transaction, and sets payment terms and the repayment schedule. The BNPL provider pays the supplier the full transaction amount up front. | When a consumer selects products or services to purchase, a BNPL provider performs a buyer creditworthiness check, approves the credit, and offers a payment plan. The BNPL provider pays the retailer the full transaction amount up front. |

| Technical considerations | – Integrating with business systems like ERPs or CRMs – Creating a transparent fee structure – Applying reliable credit assessment algorithms | – Integrating with merchant platforms – Creating a user-friendly and intuitive interface – Applying advanced algorithms for rapid credit checks and approvals |

| Revenue models | – Interest-based – Late fee-based – Merchant fees for transactions | – Interest-based – Late fee-based – Merchant fees for transactions – Interchange fees from card networks |

Moreover, when planning to develop a custom Buy Now Pay Later solution, you need to consider multiple aspects:

- Payment plans. Many BNPL providers offer fixed installments, splitting the purchase amount into equal interest-free payments, typically due over a short period of time. Other providers propose flexible or longer-term plans for larger purchases, or defer full payment for up to 30 days. Which payment plan(s) you should offer will depend on your target audience.

- Interest rates. Most short-term payment plans charge no interest for on-time payments. For longer-term plans or larger purchases, BNPL providers may charge interest depending on the customer’s creditworthiness and the payment plan terms.

- Late fees. Some BNPL providers may not apply late fees for their standard plans, though this can vary by region or merchant agreement. Some may charge late fees for missed payments.

- Purchase limits. Depending on the target audience of a BNPL provider, purchase limits may range from low to moderate for retail purchases of items like clothing, while higher limits may exist for travel or healthcare services, as well as for B2B customers.

- Repayment methods. Most BNPL providers require linking a debit card or bank account for automatic payments, reducing the risk of missed payments. Others enable use of existing credit cards, splitting the cost of a purchase into installments without issuing a new loan.

- Credit checks. Most BNPL solutions use soft credit checks. Credit approval is often based on purchase amount, payment history with the provider, or basic financial data. For larger loans or longer terms, providers may perform a hard credit check or appeal to a credit bureau for information.

When building a custom BNPL solution, you can mix the above approaches, proposing diversified options to your customers. However, to get competitive BNPL software, it’s also important to thoroughly define its functionality. In the next section, we explore what basic and advanced features you need to consider to build a BNPL app that can outperform your competitors.

Read also

How to Create a Reliable SaaS Accounting Solution: Core Characteristics, Architectural Components, and Features

Learn how a custom SaaS solution can help address unique business needs and what to consider when building your own product.

Must-have and advanced BNPL features

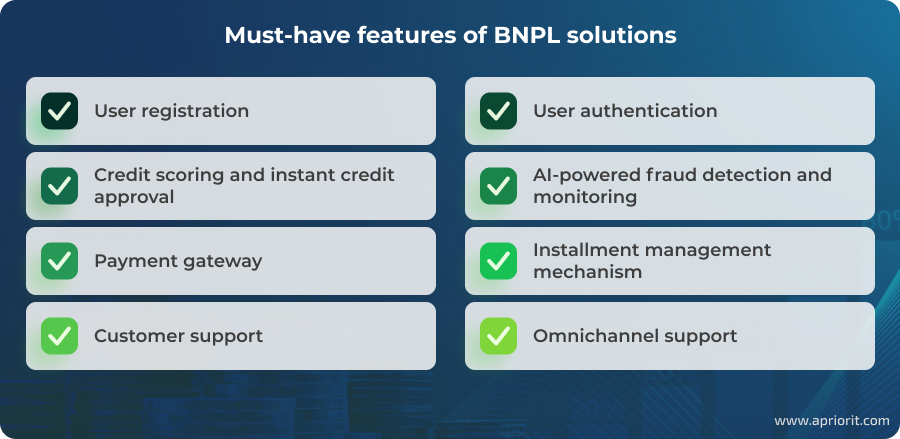

Every solution needs a definite set of features to fulfill basic operations and get the expected result. Essential features of a BNPL solution that you should definitely consider adding include:

- User registration. Since every FinTech product must adhere to Know Your Customer procedures for identity verification, the registration form of a BNPL solution must collect the following:

- Basic information on the user (name, date of birth, address)

- Identity verification data (from a government-issued ID or biometric verification)

- Payment details like debit card data

- User authentication. Robust user authentication mechanisms protect users’ sensitive data, ensure secure transactions, and prevent fraudulent activities. These mechanisms include and may combine standard authentication methods like passwords, two-factor authentication, and biometric authentication methods such as facial recognition.

- Credit scoring and instant credit approval. A credit scoring mechanism is aimed at performing soft and hard credit checks that result in approval or denial of the requested credit. This feature may leverage AI technologies to assess risk of non-payment based on a user’s credit score, spending patterns, and purchase history, helping to make prompt credit approval decisions.

- AI-powered fraud detection and monitoring. This feature detects and tracks fraudulent activities from user registration through credit approval. AI algorithms allow for analyzing big datasets to identify new fraud patterns and adapt to new threats.

- Payment gateway. An integrated payment gateway provides multiple payment methods and ensures seamless transactions among all participants in the BNPL process, real-time transaction tracking, and instant merchant settlements.

- Installment management mechanism. An efficient installment management system allows for smooth installment scheduling — for example, by enabling a recurring payment option; tracking outstanding, upcoming, and completed payments; notifying about due and confirmed payments; applying penalties for missed payments; and reporting to a credit bureau.

- Customer support. A reliable customer support system helps handle queries, disputes, payments, refunds, and fraud-related issues promptly and efficiently. For example, AI chatbots and virtual assistants can resolve payment queries, find out the status of a refund, troubleshoot payment failures, and escalate complex issues to human consultants.

- Omnichannel support. Access to BNPL options across various platforms, such as websites, mobile apps, and offline stores, can help to attract new customers, retain current ones, and increase brand awareness.

When aiming to raise customer loyalty and enhance competitive advantages, you can also combine basic features with nice-to-have ones. The most popular advanced BNPL features include:

- Virtual cards enable users to access a wide range of merchants, including those who don’t integrate with your BNPL solution directly. Virtual cards enhance the customer experience and reduce the risk of fraud because primary account details are not exposed.

- Budgeting and spending tools help users effectively manage their budgets and make more informed financial decisions. For example, providing users with up-to-date information on their expenditures allows them to view outstanding balances and upcoming payments, while considering BNPL transactions in overall financial planning lets users handle their finances more precisely.

- Rewards and loyalty programs provide different incentives, from discounts on loans to cashback for on-time payments and frequent use, that can help retain BNPL customers and enhance their loyalty.

- Personalized offers increase user engagement and promote responsible spending. AI technology can analyze user data and behavior patterns to create personalized installment plans.

- Multi-currency support allows customers to process transactions in various currencies. This minimizes currency exchange difficulties, simplifies the purchasing process, and enhances the user experience for both consumers and merchants.

Note: This list isn’t exhaustive, as custom development allows you to constantly extend your solution’s functionality while considering emerging demands and new trends.

Depending on the features you want to implement, you also need to define what technologies you will use to get a reliable, secure, and efficient solution.

Choosing a technology stack for BNPL apps

Below is a list of technologies you can use to build and integrate the components of a BNPL solution. Let’s explore it in detail.

Table 2: Technologies for building BNPL solutions

| Component | Technology | Purpose |

|---|---|---|

| Programming languages | Java, Python, JavaScript, PHP, Go, .NET, C#, Kotlin, Swift | Handling user authentication, payment processing, and installments; developing mobile applications |

| Database | PostgreSQL, MySQL, MongoDB, Redis | Storing and managing user and transaction data |

| Payment gateway | Stripe, PayPal, Braintree, Apple Pay | Managing transactions, installment processing, and payment methods |

| Front end | Angular, React.js, Vue.js, React Native, Flutter | Building the user interface; developing cross-platform apps |

| Cloud infrastructure | AWS, Azure, GCP | Enabling scalability and high performance |

| Push notifications | Firebase Cloud Messaging, Twilio | Implementing user notifications |

| Monitoring and analytics | New Relic, Google Analytics, Datadog | Monitoring performance and analyzing user behavior |

| Security | SSL/TLS encryption, OAuth 2.0, JWT | Ensuring secure user authentication, authorization, and data encryption |

Correctly chosen technologies allow you to create a reliable solution that can adapt to users’ multiple and changing demands. To help you pick out a technology stack for your BNPL solution, you can engage Apriorit specialists who have experience in building FinTech products. If you want to know what else to expect while developing a BNPL solution, take a look at the next section and discover helpful tips from Apriorit experts for addressing common pitfalls.

Read also

Python for Building FinTech Solutions: Benefits, Tools, and Use Cases

Find out why Python is a good choice for building FinTech software and what to consider when developing such a solution.

What to consider when developing BNPL solutions: Apriorit’s take

To build a user-friendly, secure, and efficient BNPL app that aligns with your business goals, consider the following:

Interface accessibility. A simple and intuitive interface is essential for FinTech applications since it helps users make financial decisions confidently. Moreover, a user-friendly UI enhances the user experience and customer loyalty.

How Apriorit can help: Our specialists in web and mobile development are ready to build a minimum viable product (MVP) tailored to your needs. Having an MVP version allows you to perform beta testing, collect valuable feedback from your customers, and consider their opinions while creating a full-fledged product.

AI model integration. Using AI algorithms enhances credit risk assessment, fraud detection, and customer personalization. However, choosing an appropriate AI model and preparing datasets for its training is not trivial and requires engaging specialists in AI.

How Apriorit can help: Our experts in AI and ML technologies will select a fitting AI model, prepare a custom dataset for its training, and integrate the model into your infrastructure. After integrating a trained AI model, we can also provide maintenance services to regularly enhance the model’s accuracy.

Security and data privacy. As BNPL solutions have access to sensitive financial information and personal data, they are often subject to cyber attacks. Poor implementation of authentication or data encryption, as well as insecure integrations of third-party APIs, may lead to legal consequences.

How Apriorit can help: With more than 20 years of experience in cybersecurity, we adhere to secure SDLC principles. Whether we are developing a product from scratch or integrating third-party solutions, we employ advanced cybersecurity mechanisms, such as access management technologies or end-to-end encryption, to ensure strong data protection and overall security.

Scalability and performance. Seamlessly handling a growing number of transactions is a challenge for any BNPL solution. To mitigate the risk of failure or delay in the work of your app, it’s essential to lay the foundation for long-term scalability at the architectural level.

How Apriorit can help: When designing a product architecture, we consider the possibilities for horizontal scaling of your product. Horizontal scaling will let you scale your solution according to your needs, ensuring high performance during periods of peak use, and is more flexible and cost-effective than vertical scaling.

Regulatory compliance. Requirements imposed by PCI DSS, KYC, AML, GDPR, and PCD2 strictly govern the financial services sector. Depending on the market in which you want to offer your BNPL services, you might also need to comply with local or industry-specific requirements to avoid potential legal or reputational risks.

How Apriorit can help: Before moving to solution development, it’s crucial to understand the exact regulatory requirements that govern your BNPL solution. Our experts can join forces with you to figure out what requirements to consider and what features to implement to achieve compliance.

Vendor reliability. When outsourcing software development to an external vendor, it’s important to employ a team of professionals with profound knowledge in FinTech software implementation. This will allow you to avoid all the pitfalls and get a robust solution that meets your expectations.

How Apriorit can help: Whether you want to create your own product from scratch or extend your current BNPL solution, a team of Apriorit experts in developing FinTech software is ready to share their knowledge and deliver a secure and efficient BNPL solution.

Conclusion

The rising BNPL market offers a vast range of solutions focusing on different target audiences and offering different credit terms. Before entering this market, it’s important to decide what solution you want to build to reach your business goals and satisfy your customers. A careful choice of technologies and functionalities will let you meet the specific needs of your market niche without compromising security.

At Apriorit, we have a FinTech development team who will build you reliable BNPL software, from estimating the required scope and resources to maintaining your solution after its release.

Want to create a BNPL solution of premium quality?

Cooperate with Apriorit experts to develop a secure and high-performance FinTech app.