Building a mobile banking app is a necessity if you want to stay competitive and satisfy customers’ growing needs. However, before proceeding to development, it’s essential to understand what exactly you will offer to your customers to meet their expectations and how to arrange the development process to avoid potential challenges in the future.

In this article, we explore the business benefits of mobile banking apps and their must-have and nice-to-have features. In addition, we take a look at phases of the development process and challenges you may face while building your app.

This article will be useful for technical decision-makers who are considering developing a custom mobile app and are looking for modern solutions, trends, and approaches.

Why do banking businesses rely on mobile apps?

Having disrupted the banking services market, mobile apps are among the key offers of many financial institutions. According to Statista, in the US, the share of bank account holders who leveraged mobile banking apps stood at 63% in the first quarter of 2024. During the same period, the popularity of physical bank branches has declined.

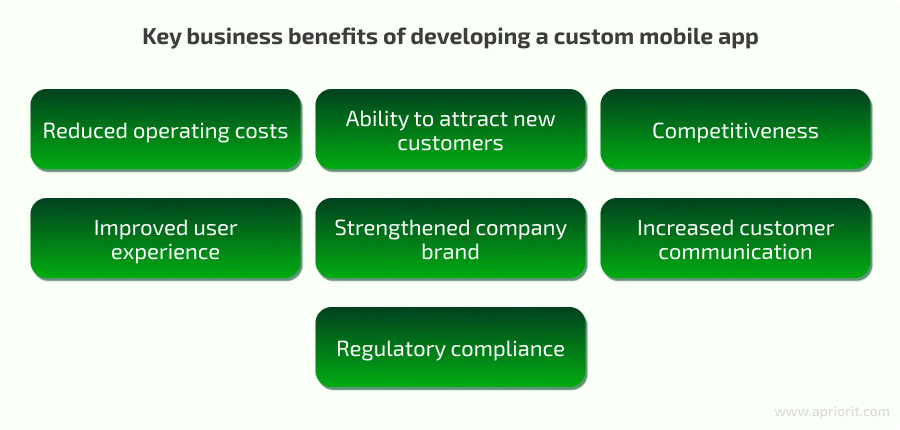

By offering mobile apps to customers, banking businesses can get a range of benefits including:

- Reduced operating costs: The ability for clients to handle routine tasks via a mobile banking app reduces a bank’s operating costs including for rent, staff, and utilities.

- Ability to attract new customers: A well-built mobile banking app allows a bank to extend its client base by attracting a diverse audience, including remote and digital-savvy clients.

- Competitiveness: A custom mobile banking app with must-have and nice-to-have features will let you satisfy customers’ needs and compete in the market.

- Improved user experience: By building a mobile banking app, you will help your customers solve a majority of their issues without visiting a branch.

- Strengthened company brand: A mobile banking app increases user loyalty and positions your business as one that keeps up with the latest trends.

- Increased customer communication: Personalized notifications and support channels enhance communication with customers and strengthen relations between customers and your business. Effective communication will allow you to promote services and increase your revenue.

- Regulatory compliance: Developing a custom application with your requirements and regulatory compliance in mind will improve your business reputation and help you avoid penalties and legal action.

To gain these benefits, banks offer different types of apps to their customers. Among the diverse range of mobile banking apps we can outline those that aim to provide a specific scope of services. Let’s explore what types of banking apps exist.

Looking to build a custom banking app that meets market demands?

Entrust your app to experts in fintech app development. A team of Apriorit specialists will help you build a custom mobile banking app from scratch in compliance with the highest security demands.

What type of mobile banking app do you need?

Understanding what mobile banking app you need is crucial for building your development strategy. Key types of mobile banking apps include:

- Retail online banking apps: These are designed to meet the needs of individual customers: balance checks, funds transfers, bill payments, access to transaction history, and more.

- Mobile banking apps for business: Built to satisfy business needs, these apps allow for managing loans, payrolls, and different financial activities that can be carried out in a typical business banking system.

- Mobile wallet apps: Featuring contactless payments and easy e-commerce integration, this type of app is becoming more popular among those who seek secure cardless transactions.

- Peer-to-peer payment apps: The main goal of these apps is to ensure easy fund transfers between individuals.

- Credit management apps: These apps help users apply for and keep track of loans.

- Neobanking apps: Neobanks are completely digital, and their apps feature a streamlined user interface. Leveraging advanced technologies like AI and ML allows them to provide personalized services and improve security.

It’s also important to mention cryptocurrency and blockchain apps. These fintech apps are designed to manage digital currencies, offering services like cryptocurrency wallets and exchanges. They are decentralized and, therefore, faster, more secure, and more efficient than traditional apps.

Every mobile app has a set of features aimed to satisfy users’ specific needs. Let’s find out what key features a competitive app must have to meet customers’ expectations.

Related project

Decentralized Blockchain Application for International Remittance Payments

Explore how Apriorit specialists designed an innovative blockchain solution that helped our customer support a high volume of transactions.

Must-have mobile banking features

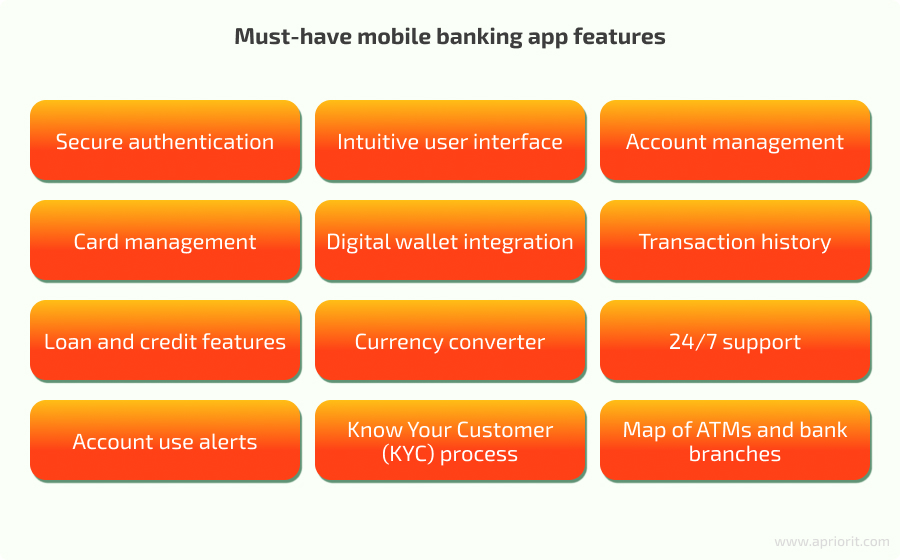

For fully fledged mobile banking apps, it is essential to have a certain range of features that allow your customers to perform tasks promptly and securely. These include:

- Secure authentication: Integration of two-factor authentication and biometric authentication methods, such as fingerprints and facial features, enhances the protection of sensitive data and speeds up user log-in.

- Intuitive user interface: An intuitive design helps users easily interact with an app and improves the user experience. Such a design simplifies navigation, makes financial tasks less complicated, and stimulates users to explore different app features.

- Account management: By leveraging convenient dashboards, users can review the state of their finances, personalize the app interface, and configure account settings depending on their needs.

- Card management: The ability to manage funds and control cards on the fly provides users with more autonomy.

- Digital wallet integration: Support of contactless transactions guarantees a secure payment experience and attracts tech-savvy customers.

- Transaction history: This feature helps users review their expenses and banking account activity. It also improves financial tracking and management.

- Loan and credit features: The ability to apply for a loan directly within a mobile banking app simplifies the borrowing process and enhances customer loyalty.

- Currency converter: Integrating an API that provides the latest exchange rates can keep customers informed and enable real-time currency exchange operations.

- 24/7 support: By providing 24/7 support, you help your customers solve their issues rapidly and outside of working hours, enhancing their trust and loyalty.

- Account use alerts: Notifying users of any changes to their account balances and of any detected suspicious activity allows them to react promptly to such changes and enhance their account security.

- KYC process: By conducting KYC checks within the app, you can prevent malicious customer actions and protect your business against fraud, money laundering, and terrorist financing.

- Map of ATMs and bank branches: An integrated map helps your customers save time and find the nearest ATM or physical branch effortlessly.

The final set of features will depend on the services offered, your target audience, and the market for which you are developing your app. In addition to the basic features listed above, it’s essential to add unique features for a fully fledged mobile banking app. Let’s explore what they can be.

Advanced mobile banking features

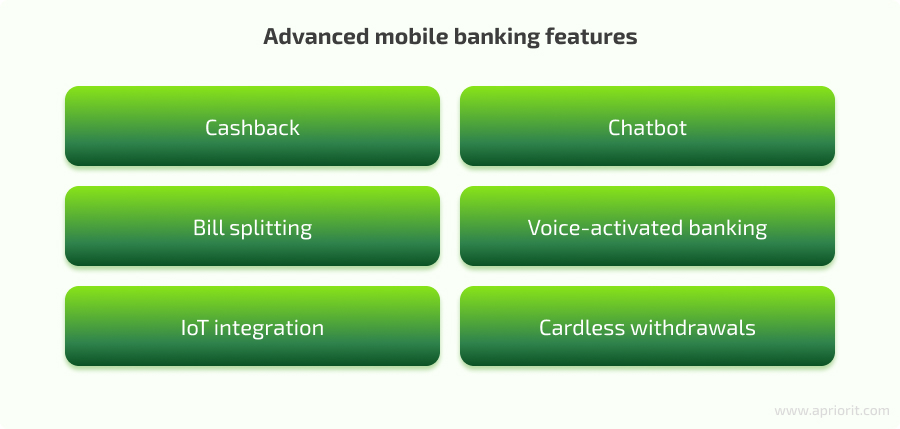

Innovative features aimed at improving the customer experience and customer loyalty include:

- Cashback: This feature motivates your customers to use the mobile banking app more often and helps you build lasting customer relationships.

- Chatbot: Instant customer support through a chatbot lets your customers solve most of their issues rapidly.

- Bill splitting: This feature helps your customers split and pay for shared expenses, simplifying the settlement process and eliminating the need for cash transactions.

- Voice-activated banking: Managing financial activity through voice commands will enhance the payment experience and make your app more inclusive.

- IoT integration: The ability to link devices to a mobile banking app simplifies payments and makes them more secure.

- Cardless withdrawals: Withdrawing funds from an ATM with a mobile banking app eliminates the need to use a physical card and improves the security of the cash withdrawal procedure.

This is just a brief list of features you can offer your customers to enhance their experience.

Besides the choice of features, it’s also important to arrange the development process correctly. Let’s take a look at the main steps of building a top-notch mobile banking app and explore why they are essential.

Read also

How to Ensure Your Mobile Banking App Security: Tips and Best Practices

Learn why mobile banking app security is important and how Apriorit security experts can help you build a mobile banking app that is resistant to cybersecurity attacks.

How to build a mobile banking app

Now that you know what type of app you want to build and what set of features you want to integrate, let’s explore how to organize your banking mobile app development process step by step to achieve your goals:

Perform market research and competitor analysis: During the discovery phase, it’s essential to conduct market research to understand what your users need, analyze existing apps to find out what they offer and what they miss, ask users about their preferences and expectations, and monitor market trends for future user demands. This will help you discover pitfalls at the very beginning, get a common product vision, and optimize the development process.

Design an intuitive user interface: Use UI/UX best practices to create a clear and simple interface. A well-designed mobile banking app will let users perform financial transactions faster.

Choose a technology stack: Define a stack of technologies depending on the type of app you are developing. Take into account that the choice of technologies can impact your app’s future capabilities, such as scalability and performance. As an example, let’s take a look at a list of technologies that are widely used in native mobile app development:

- For Android-based applications, you can use the following stack:

- Java, Kotlin

- Android Studio, Android Developer Tools

- Android SDK

- For iOS-based applications, you can choose the following:

- Swift, Objective-C

- Xcode

- iOS SDK

Implement an MVP: This step includes building an app with basic features, performing beta testing, and making changes to the design to enhance the user experience. By implementing an MVP, you can avoid mistakes in the development process and discover your app’s weaknesses.

Ensure security and regulatory compliance: Protecting sensitive data is paramount for any mobile banking app. Employing the best authorization technologies and encryption methods, performing vulnerability audits, and releasing regular security updates will ensure the security of your app and compliance with data protection standards and regulations.

Develop and release the app: At this stage, you can proceed to developing a fully fledged app. At Apriorit, we recommend an iterative approach, as it allows us to break down the development process and improve software efficiency and quality.

Maintain and improve the app after release: To ensure your application stays relevant years after its release, it’s important to constantly maintain and improve it. Monitoring and enhancing app performance and promptly fixing issues will extend the life of your app, while prioritizing customer features and integrating trendy ones will allow your app to be competitive and user-oriented for a long time.

Developing a mobile banking app may present a set of challenges. Understanding what they are and how to manage them will make the overall development process easier and more predictable. Let’s see what challenges may occur and how to handle them.

Read also

5 Cases When Having a Business Analyst Is a Must for Your Project

Find out why a business analyst is important for your project and how Apriorit can help you find one.

Challenges of building a mobile banking app

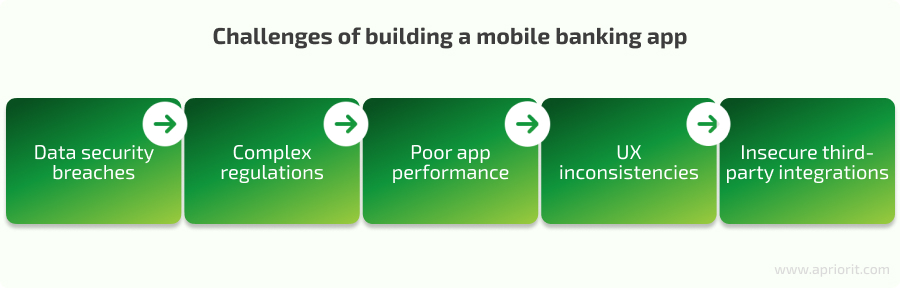

Below is a list of the most common challenges you may face while developing your mobile banking app. They include:

- Data security breaches: Constantly increasing cyber threats are a key challenge for any mobile banking app. Integrating advanced security measures will ensure data protection and decrease the possibility of breaches. While building mobile banking apps, Apriorit specialists leverage best practices to enhance their security. These include establishing secure communication protocols, ensuring robust session management security, and implementing strong authentication methods.

- Complex regulations: Due to complex and frequently changing regulatory requirements, it’s important to perform regular compliance audits. For example, the General Data Protection Regulation (GDPR) governs personal data processing, while the Payment Card Industry Data Security Standard (PCI DSS) is aimed at protecting card data.

- Poor app performance: Interruptions in the work of app services irritate users and may be a reason for deleting your app. Integrating your app with cloud services will enhance your app’s performance. This will allow you to scale your app according to your business needs and smoothly handle traffic peaks. Apriorit specialists can ensure your app is securely integrated with cloud services and assist you with managing infrastructure on different cloud platforms.

- UX inconsistencies: An inconsistent user experience across devices diminishes user satisfaction. Make sure that the UX of your web version is consistent with the UX of your mobile app and that data is synchronized across all systems and devices.

- Insecure third-party integrations: Integrating ready-made solutions such as an ATM locator, push notifications, or identity verification tools allows you to extend your app’s functionality. Integrations speed up the development process and enhance the user experience. Leveraging third-party APIs is cost-effective and allows you to save money for unique features. However, before integrating third-party services, you need to consider the security measures implemented by API providers. With extensive API integration experience, Apriorit experts can check the security and efficiency of third-party integrations.

To overcome all the challenges and pitfalls of mobile banking app development, it’s essential to engage a team of experts who are able to deliver professional services, from the discovery phase to quality assurance.

How Apriorit can help you build a mobile banking app

Apriorit has a dedicated development team with profound knowledge of how to create a mobile banking app and can cover the full cycle of mobile development as well as provide you with expertise in fintech and advanced technologies such as AI and the blockchain.

We offer a wide range of services, from market research to post-release software support. Our team of experienced developers, quality assurance specialists, and business analysts will help you build a development strategy to deliver a competitive, well-protected, and user-friendly product.

Our team can help you with:

- Conducting a discovery phase: This allows you to identify and avoid potential challenges at the very beginning of the development process. To conduct a discovery phase, you can engage an experienced Apriorit business analyst who will carry out initial research to discover possible pitfalls and ways to overcome them, elicit requirements, and prepare a final software requirements specification.

- Building a scalable mobile banking app: By scaling your mobile app, you will be able to manage a growing user base without impacting performance. Apriorit specialists will offer you different approaches to scale your mobile banking app depending on your needs and budget, from a microservices architecture to cloud integration.

- Integrating robust security measures: Since a mobile banking app is a source of sensitive data, any breaches can lead to reputational risks and loss of customers’ trust. At Apriorit, we know how to maximize app security by implementing cybersecurity best practices that will meet your specific needs.

- Providing quality assurance: Delivering a high-quality product is not possible without thorough testing, from requirements to acceptance. Apriorit’s QA specialists can provide full-cycle testing of your app, including security testing against potential threats.

- Ensuring post-release software maintenance: Efficient maintenance of your app after release will ensure its safety and stability. By engaging Apriorit’s specialists, you will get a proactive maintenance strategy that includes extending your app’s functionality and enhancing its current features.

Conclusion

Before you start building your mobile banking app, it’s important to figure out what type of app you want to create to satisfy your customers’ needs, what features it will have, and what challenges you may encounter.

To build a top-notch mobile banking app, it’s essential to trust the process to specialists with mobile development expertise who will consult and assist you throughout the whole development process and will take on potential challenges.

For 20+ years, Apriorit has helped businesses build competitive, user-friendly, and secure mobile apps. Our specialists are ready to share their experience in custom mobile app development. Furthermore, Apriorit can help you improve your existing mobile banking app by extending its functionality with AI models or enhance its security through security testing.

Looking for specialists in mobile app development?

Entrust your development challenges to Apriorit experts.