Key takeaways:

- Fintech APIs are essential for secure and real-time data exchange, contributing to innovation in digital financial services.

- Choosing the right API type without disrupting existing systems can greatly boost your project success.

- Custom APIs might be the right choice if your FinTech software requires tailored functionality or additional security measures.

- Expertise in API development, cybersecurity, compliance, and system architecture is crucial for creating or integrating reliable fintech APIs.

Fintech application programming interfaces (APIs) play a crucial role in enabling secure, automated, real-time data exchange. However, there are critical challenges, like balancing security with convenience for users, ensuring regulatory compliance, and scaling digital services without disrupting existing infrastructures. Whether you’re building a new financial product or optimizing legacy systems, choosing and implementing the right APIs can make or break your success.

In this article, we’ll explore what fintech APIs are, why they are essential, and how you can leverage them to optimize innovation and grow your business. This article is aimed at fintech project leaders who are looking to enhance their digital services, optimize the existing infrastructure of their financial software, or ensure security and compliance in financial transactions.

Contents:

- What are fintech APIs, and why do you need them?

- How do fintech APIs function?

- Fintech API types: Which one fits your needs?

- Things to consider before integrating APIs into your fintech project

- Custom fintech APIs: when to build instead of buy

- How Apriorit can help with API development and integration

- Conclusion

What are fintech APIs, and why do you need them?

Fintech APIs are software intermediaries that allow different financial applications to communicate and exchange data. These tools can be third-party or custom-built, and help institutions integrate services and automate complex financial operations without compromising security. Fintech APIs are the backbone of seamless, secure, and innovative financial services.

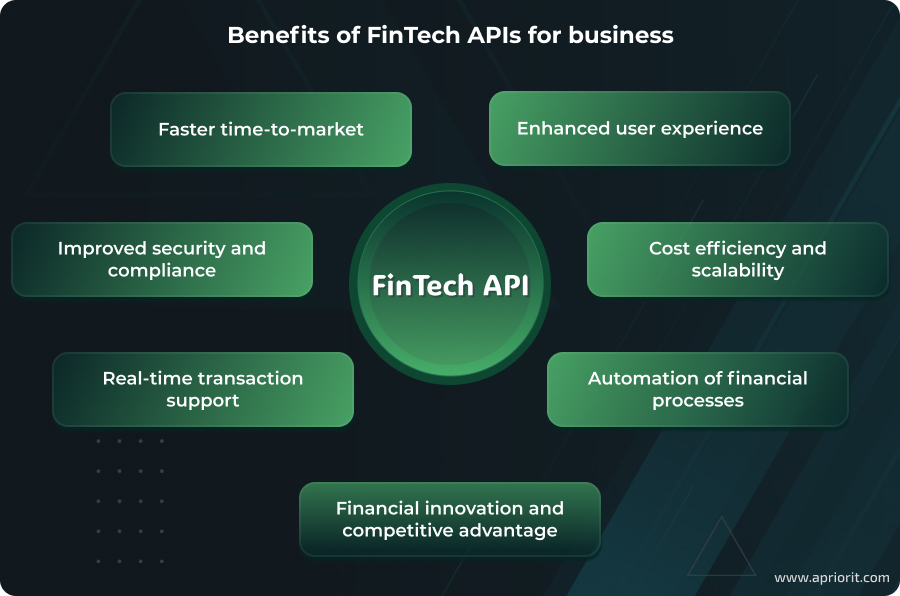

As the demand for digital financial services grows, so does the reliance on APIs. According to industry forecasts, the number of open banking API calls is expected to grow from 102 billion in 2023 to 580 billion in 2027. This underscores the increasing reliance of modern financial ecosystems on APIs. For financial institutions and fintech startups, APIs offer many advantages:

- Faster time-to-market. Businesses can quickly launch new banking and financial products by integrating APIs instead of building everything from scratch.

- Enhanced user experience. APIs allow companies to offer seamless, real-time financial services, such as instant payments and digital banking.

- Improved security and compliance. Many fintech APIs come with built-in fraud detection, encryption, and requirements for complying with security standards, reducing legal and security risks.

- Cost efficiency and scalability. Instead of building complex payment processing, banking, or compliance mechanisms from scratch, APIs provide these functions on demand. This allows businesses to scale financial services efficiently and without significant overhead.

- Real-time transaction support. APIs support instant payments, fund transfers, and financial verifications, which boosts customer experience and operational efficiency.

- Automation of financial processes. Businesses can reduce manual intervention by using APIs for fraud detection, credit scoring, Know Your Customer (KYC) verification, and more.

- Financial innovation and competitive advantage. Open banking APIs empower fintech startups and financial institutions to create customer-centric products and services while maintaining compliance and security.

Fintech APIs act as bridges between banks, payment processors, fintech startups, and other financial institutions. Businesses can integrate services like payments, digital banking, trading, lending, risk assessment, and compliance checks without building them from scratch. So, how exactly do these APIs work to help you achieve secure and efficient transactions? Let’s explore the working mechanisms in more detail.

Want to build a custom API for your Fintech product?

Our team specializes in building robust APIs that boost system interoperability, automate workflows, and unlock new possibilities for your business.

How do fintech APIs function?

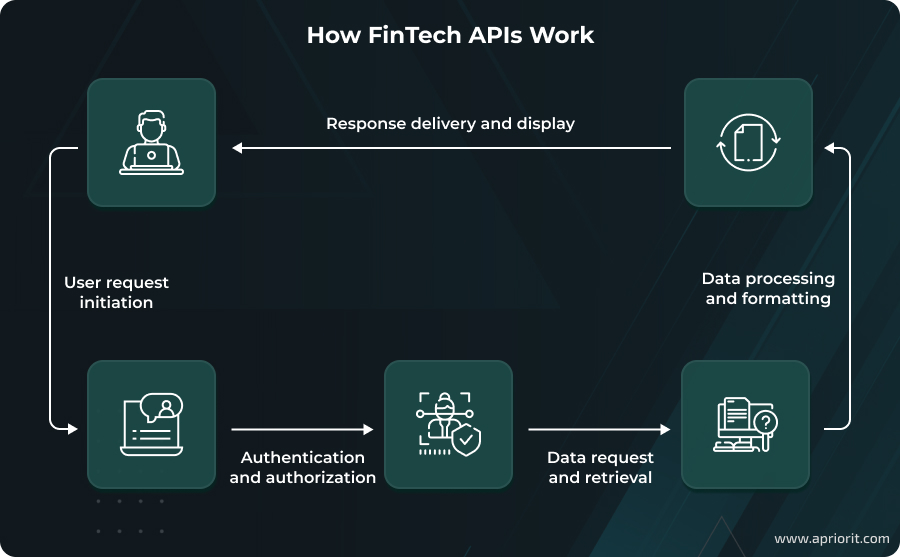

To examine how fintech APIs work, let’s break down the typical workflow with an example where a user opens a budgeting app to check their current bank account balance. Here’s what happens when an application sends an API request to the user’s bank:

User request initiation. A user opens a budgeting app and wants to check their current bank account balance. The app does not store this data itself, so it sends an API request to the user’s bank to retrieve the balance.

Authentication and authorization. The API verifies the identity of the requesting application and the user with authentication protocols such as OAuth 2.0, OpenID Connect, or API keys. The user grants the budgeting app permission to access their account details through a secure login process, and the bank’s API confirms this authorization.

Data request and retrieval. After successful authentication and authorization, the API securely sends a request to the bank’s system to retrieve the latest account balance. The bank’s backend processes this request and fetches the relevant account details.

Data processing and formatting. Since financial institutions often store data in various formats, the API translates the response from a banking system into a standardized format, such as JSON or XML. This is necessary to make sure that the third-party application can interpret the received data.

Response delivery and display. The API returns the processed data to the third-party application, which presents it to the user in a user-friendly interface. In our example, the budgeting app displays the account balance in real time, allowing the user to track their finances and execute more operations if needed.

This is the standard workflow for a fintech API; however, it can change depending on the API type. Let’s take a look at the key API types for fintech and how to choose the best one for your needs.

Read also

Securing APIs for Your Software: 6 Best Practices

APIs are a prime target for cyber threats. Discover essential best practices to protect your APIs from common threats and ensure secure data exchange.

Fintech API types: Which one fits your needs?

Fintech APIs offer a wide range of functionalities to cater to the specific needs of businesses or developers. They can be broadly categorized based on their accessibility and intended use:

- Public — best for fintech startups, developers building consumer-focused applications, and companies looking to integrate open banking solutions

- Private — best for banks, large enterprises, and financial institutions needing secure and controlled data access

- Partner — best for businesses that work with external service providers, such as payment processors or insurance partners

- Composite — best for companies needing seamless interactions across multiple financial services, such as multi-platform payment solutions

To learn more about each category of APIs, explore our article Third-Party API Integrations for Your Software: Benefits, Challenges, and Best Practices.

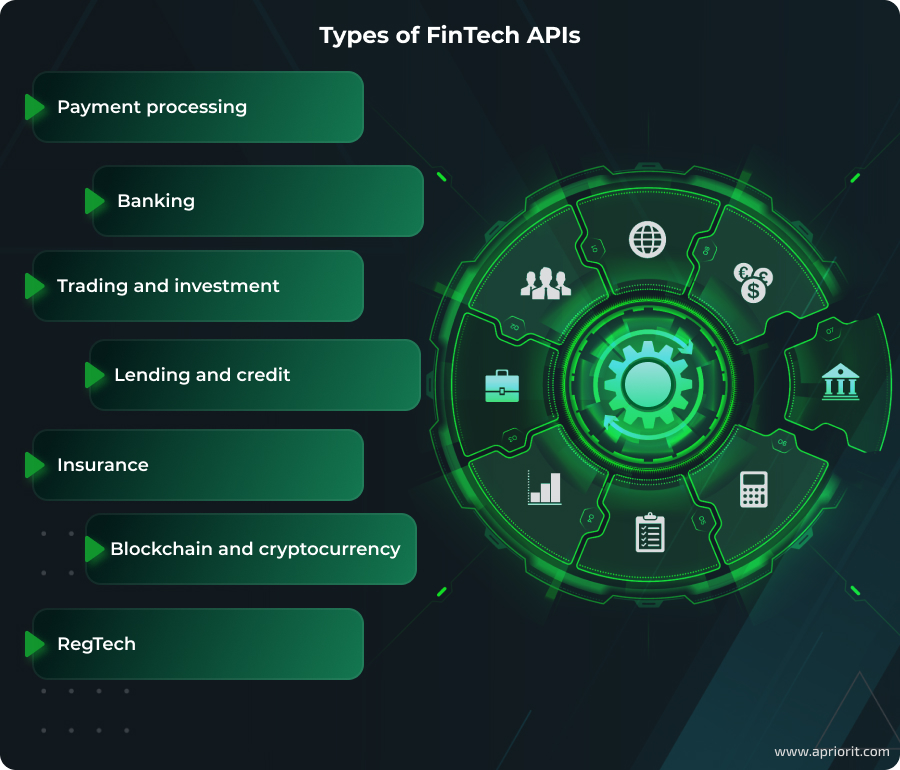

In addition to these categories, each fintech API is designed to support a specific financial function. Here are the most common types and tips to determine which one’s right for your business:

Payment processing. These APIs facilitate online transactions and allow businesses to accept payments with the help of credit or debit cards and mobile wallets. APIs from Stripe and PayPal handle secure payment processing, fraud prevention, and transaction management.

- Best for: E-commerce platforms, subscription services, and businesses that need to process online payments

- Tip from Apriorit: Look for APIs that offer fraud prevention, easy integration, and multi-currency support.

Banking. These APIs provide access to banking data and functions, giving third-party applications the ability to retrieve account information, initiate payments, and perform other banking-related tasks. Open banking and PSD2 regulations have contributed significantly to the adoption of this API type, guaranteeing the safety and security of private data.

- Best for: Banking apps, personal finance tools, and companies offering financial management services

- Tip from Apriorit: Choose API for fintech that uses strong authentication like OAuth 2.0 and complies with financial regulations.

Trading and investment. These APIs provide access to stock market data, enable automated trading, and offer portfolio management tools.

- Best for: Investment platforms, robo-advisors, and algorithmic trading firms offering stock trading

- Tip from Apriorit: Make sure to implement real-time data access and robust security features to protect user investments.

Lending and credit. With the help of these APIs, lenders and borrowers can communicate with each other and automate loan applications, credit scoring, and loan management. In general, they streamline the lending process and improve access to credit.

- Best for: Lenders, credit scoring companies, and businesses offering financial assistance programs

- Tip from Apriorit: Opt for APIs that show the results of credit risk assessment and integrate with multiple financial institutions.

Insurance. These APIs automate insurance processes, from policy management and claim processing to risk assessment and underwriting. They also boost the development of innovative insurance products.

- Best for: Insurtech startups, traditional insurance companies, and financial institutions offering coverage plans

- Tip from Apriorit: Look for APIs that connect you with underwriting automation and AI-powered risk assessment tools.

Blockchain and cryptocurrency. With the help of APIs from Coinbase or Bitquery, users gain access to blockchain data and cryptocurrency exchange services. These APIs enable developers to build applications related to cryptocurrency trading, wallet management, and blockchain analytics.

- Best for: Crypto exchanges, blockchain analytics firms, and businesses integrating crypto payments

- Tip from Apriorit: Ensure compliance with cryptocurrency regulations and choose APIs that support multiple blockchain networks.

Regulatory technology (RegTech). These APIs help financial institutions comply with regulatory requirements, such as KYC and Anti-Money Laundering (AML) regulations. They automate customer verification, identity checks, and compliance reporting.

- Best for: Banks, fintech companies, and financial service providers dealing with KYC/AML regulations

- Tip from Apriorit: Pick APIs with implemented compliance and real-time monitoring for fraud detection.

To select the right fintech API, start by identifying your core financial functions and then decide which APIs align with your goals. Whether you need payment processing, lending solutions, or regulatory compliance tools, the right API can help you streamline operations and improve the customer experience. Let’s see what challenges might arise before you implement API and how you can address them.

Up next, we’ll look at the challenges that can arise with API integrations for fintech and how Apriorit can help you address them.

Read also

Mobile Banking App Development: Benefits, Features, and Challenges

Don’t compromise on the security of your banking app. Learn how to design, build, and protect mobile financial applications from this expert guide.

Things to consider before integrating APIs into your fintech project

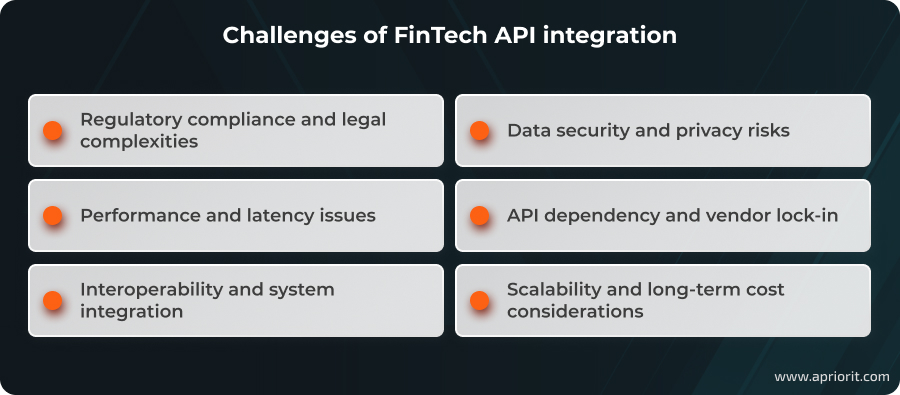

Third-party fintech APIs can introduce challenges that could potentially impact the security, performance, and long-term scalability of your software.

Regulatory compliance and legal complexities. Financial services operate under strict regulations, like PSD2, the GDPR, PCI DSS, and AML/KYC. Some third-party APIs may not fully comply with the regional or industry-specific requirements that apply to your business, leading to legal risks, financial penalties, and loss of reputation.

How we address this: Before integration, we thoroughly assess whether an API meets your compliance needs. If existing solutions fall short, Apriorit’s experts can design a custom API with built-in compliance features.

Data security and privacy risks. APIs are basically gateways to sensitive financial data, which turns them into prime targets for cyber attacks. If an API lacks encryption, authentication, or access controls, it can expose sensitive user data to breaches.

How we address this: We can help you integrate third-party APIs with strong security mechanisms, such as end-to-end encryption and role-based access controls. However, the only fool-proof method of guaranteeing security for you and your users is to develop your own custom API.

Performance and latency issues. Many third-party APIs introduce latency, especially when handling high-frequency transactions, large datasets, or real-time financial operations. This, in turn, can lead to slow response times, resulting in user frustration or critical workflow disruptions.

How we address this: Apriorit’s QA specialists can test API response times under expected load conditions and use load balancing to distribute API requests efficiently and prevent system overloads. We can also implement caching mechanisms for frequently accessed data to reduce the number of external API calls.

API dependency and vendor lock-in. This is a frequently occurring case when companies use third-party APIs. If a provider discontinues its service, modifies its pricing structure, or restricts certain features, your business may face costly migrations or functionality gaps.

How we address this: To minimize dependency, we can help you choose APIs with transparent terms and strong service-level agreements. Apriorit’s developers can also design modular architecture for your software that allows you to replace an API easily if a vendor changes its service model.

Interoperability and system integration. Not all fintech APIs are compatible with your existing tech stack, especially if you rely on legacy infrastructure. New integration challenges might require middleware, which in turn increases the complexity of development and maintenance.

How we address this: Our developers review documentation, supported protocols, and authentication mechanisms before integration. QA specialists test API integration in a sandbox environment before deployment to identify potential issues early.

Scalability and long-term cost considerations. Many APIs have tiered pricing models based on usage, transactions, or premium features. As your business grows, these costs can escalate significantly, making long-term utilization of third-party APIs quite expensive.

How we address this: Our business analysts can help you calculate projected API costs based on your expected growth. Working together, we can design hybrid solutions where core functions rely on APIs, but frequently used or high-cost processes are managed in-house.

Addressing these challenges can help you prevent disruptions in your workflows and ensure smooth integration of APIs into your project, both custom and off-the-shelf. However, there are some cases when ready-made APIs might not be the best fit.

Related project

Building an AWS-based Blockchain Infrastructure for International Banking

Learn how we helped a global bank implement a secure AWS-based blockchain infrastructure, as well as streamline transactions, ensure regulatory compliance, and enhance operational efficiency.

Custom fintech APIs: when to build instead of buy

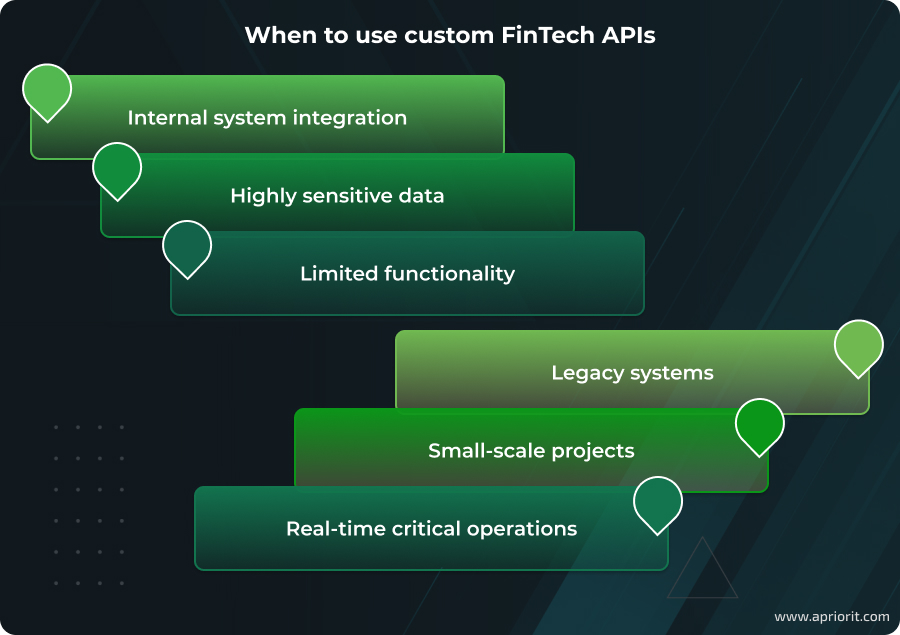

While ready-made fintech APIs provide quick access to financial functions, they might not be the ideal solution for every financial project. In some cases, developing a custom API tailored to your specific needs can offer greater flexibility, security, and efficiency. Here are some scenarios where one-size-fits-all fintech APIs may not be the best fit:

Internal system integration. Some off-the-shelf APIs can introduce an extra layer of complexity that may be unnecessary for closed-loop systems. If your business primarily needs to connect internal systems (for example, with proprietary banking software, CRM, or ERP systems), a custom API can help you achieve smooth integration without the limitations of third-party solutions.

Highly sensitive data. Relying on third-party APIs can introduce unacceptable security risks for systems handling extremely sensitive data, such as classified financial information or proprietary trading algorithms. Of course, pre-built APIs follow certain security standards, but some financial institutions and fintech startups prefer complete control over data security. With custom APIs, you can get enhanced encryption, strict access controls, and compliance with industry-specific regulations.

Limited functionality. If your project requires only very basic financial functionality that can be easily implemented in-house, integrating a complex API might be overkill. For example, if you only need to perform simple calculations or generate basic reports, developing a custom script or using existing libraries might be more straightforward and cost-effective.

Legacy systems. Integrating modern APIs with extremely outdated legacy systems can be exceptionally challenging. Legacy systems often lack the necessary interfaces, protocols, and data formats to communicate effectively with APIs. In this case, you have two options: update your legacy system or create a custom API that can bridge the gap and allow for gradual modernization without a full system overhaul.

Small-scale projects. For very small-scale projects with limited budgets or transaction volumes, the cost of API subscriptions, usage fees, and development efforts might outweigh the potential benefits. While developing a custom API requires an initial investment, it will provide long-term cost benefits, especially for businesses with high transaction volumes or specialized needs.

Real-time critical operations. For systems where absolutely zero latency or downtime is permissible, such as high-frequency trading or emergency financial systems, relying on a third-party API can be a potential risk. Since you have full control over a custom API, you can be sure to respond to any potential problem in time.

In general, if an API provider has a history of frequent downtime, performance issues, or security breaches, relying on their API can jeopardize your project’s reliability and security. If you require greater control, security, and scalability, investing in a custom API might be the key to building an efficient and future-proof financial system.

How Apriorit can help with API development and integration

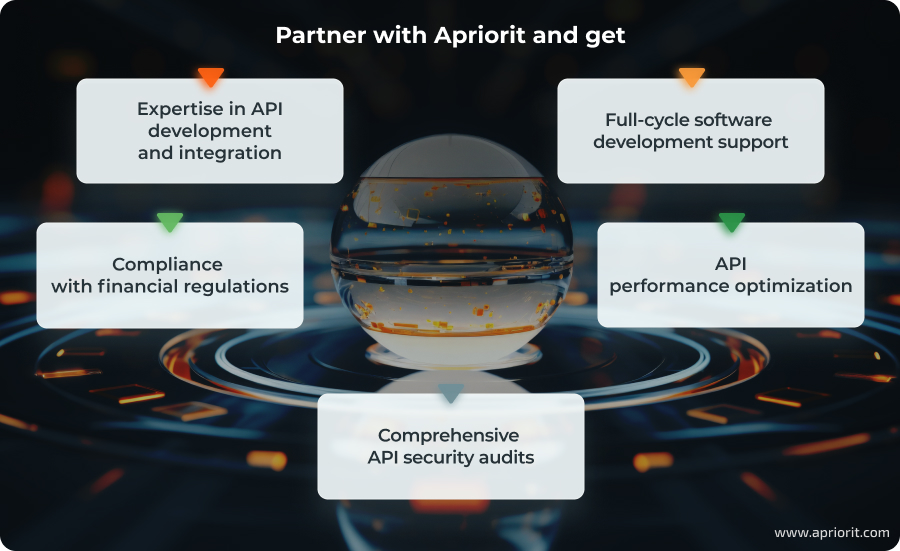

Our specialists understand that integrating the best fintech APIs requires a strategic approach. At Apriorit, we specialize in API development and integration, helping businesses build reliable, high-performance solutions tailored to their specific needs.

Expertise in API development and integration. Ensure smooth communication between your financial systems, applications, and external services. With years of experience in fintech, we help businesses seamlessly integrate third-party APIs — or develop custom ones that align with their unique requirements.

Full-cycle software development support. From the initial requirements analysis to deployment and ongoing maintenance, Apriorit provides end-to-end API development services. Whether you need to modernize legacy integrations, improve API efficiency, or create a fully customized fintech solution, you’ll receive a reliable, future-proof API.

Compliance with financial regulations. Avoid regulatory headaches with APIs designed to meet specific sets of requirements. You can rely on our specialists when it comes to compliance with key industry standards.

API performance optimization. Your API will be built for speed, scalability, and high availability to handle fintech demands. With efficient caching strategies, load balancing, and data optimization, our team will help you avoid bottlenecks and ensure fast, reliable performance — even as your business grows.

Comprehensive API security audits. Security is at the core of every fintech integration. Apriorit performs in-depth API security audits to minimize security risks with an API in fintech designed to withstand cyber threats.

Conclusion

Fintech APIs can make transactions faster, data exchange seamless, and financial services more accessible. However, their integration also comes with certain challenges, which can disrupt your operations and affect the customer’s experience. Choosing the right API strategy is key to ensuring security, compliance, and long-term success.

Whether you’re looking to integrate existing fintech APIs or develop a custom solution tailored to your business needs, Apriorit’s API development and integration experts are here to help. By partnering with us, you can build secure and high-performance financial solutions that drive business success.

Ready to create a powerful fintech API?

Partner with Apriorit to build a secure, scalable, and compliant API solution that meets your unique business needs.